-

Rising Interest Rates: A New Era in Commercial Lending Explore how rising interest rates are reshaping the commercial lending landscape, influencing business borrowing strategies, and highlighting new opportunities.

Rising Interest Rates: A New Era in Commercial Lending Explore how rising interest rates are reshaping the commercial lending landscape, influencing business borrowing strategies, and highlighting new opportunities.

matt

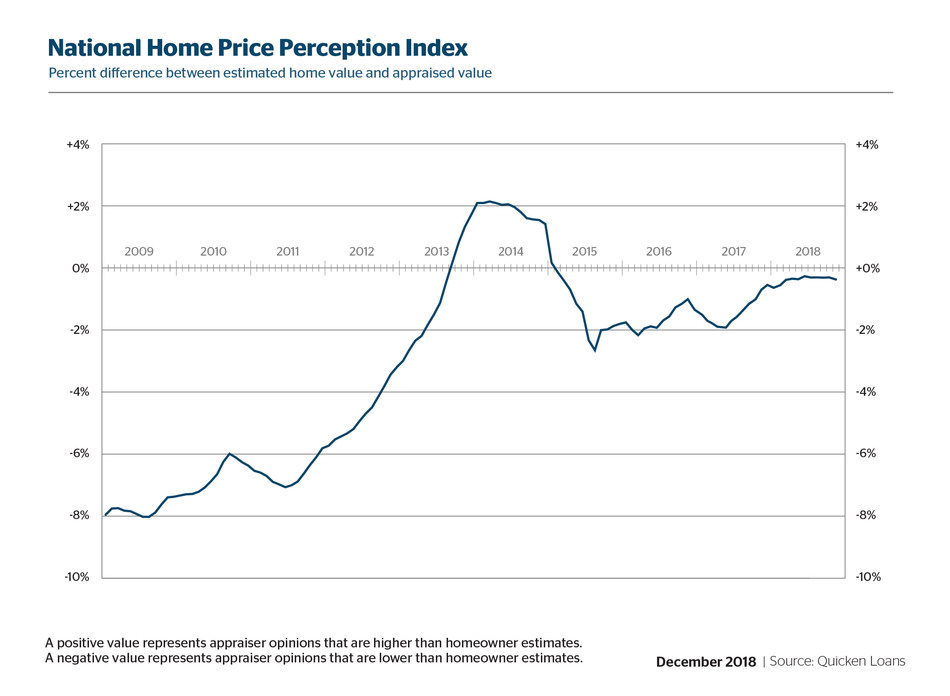

Home Price Perception Index Holding Steady

- Tuesday, 11 December 2018

The difference between owners' estimates of home values and appraisal values increased slightly in November across the U.S.

Appraised values were an average of 0.36 percent lower than what homeowners expected, according to Quicken Loans' National Home Price Perception Index. The index represents the difference between appraisers' and homeowners' opinions of home values. The index compares the estimate that the homeowner supplies on a refinance mortgage application to the appraisal that is performed later in the mortgage process.

In addition to owners and appraisers aligning on home values, there’s the growth of appraisal values across the country. Quicken Loans' National Home Value Index erased a slight dip from the previous month with a 0.53 percent increase in November. The annual gains follow a trend that has been consistent the last few months. Nationally, the average home appraisal was 5.01 percent higher than it was in November 2017.

This year has not produced much monthly movement in the gap between home appraisals and homeowners' expectations. In fact, the difference has remained below half a percent since March, with little month-to-month variation. At a metro level, Chicago is the only area with appraisals more than 2 percent lower than what homeowners estimated. Boston, Denver and Charlotte were on the other side of the spectrum--each with the average appraisal coming back more than 2 percent higher than expected in November.

[caption id="attachment_8296" align="alignleft" width="265"] Banfield: The housing market is sturdy.[/caption]

Banfield: The housing market is sturdy.[/caption]

"Homeowner perception staying at a steady level is a sign of a sturdy housing market," said Bill Banfield, executive vice president of capital markets at Quicken Loans. "Some homeowners may not be as aware of home value changes as the professionals who study the real estate market every day, so any large, sudden, spikes or drops in home values, are often reflected by a swift widening gap in the HPPI."

Home Value Index

The Quicken Loans Home Value Index reported annual home equity growth continuing to march ahead at a consistent pace. Monthly change, however is a reflecting slower, more measured increases. This is the story across the country. Not only from the national, aggregate, level but in every region – to varying degrees. Home values rose by about half of a percent in all four regions measured by the Home Value Index, while they all posted annual growth from 4 to 6 percent.

"Home values continue to increase but the rate of increases has started to slow. For much of 2018, interest rates have been rising causing the combined price and associated payment to give some buyers pause," said Banfield. "The economy appears to remain strong with a low unemployment rate suggesting home prices could continue to increase even if at a slower rate."

Chart Below: Shows Quicken's HPPI By Metro Areas

|

Metropolitan Areas

|

HPPI

November 2018

Appraiser Value |

HPPI

October 2018

Appraiser Value |

HPPI

November 2017

Appraiser Value |

| Boston | +2.92% | +2.93% | +1.63% |

| Denver | +2.47% | +2.46% | +2.36% |

| Charlotte, NC | +2.26% | +2.21% | +1.16% |

| Minneapolis | +1.94% | +1.94% | +0.70% |

| San Jose, CA | +1.94% | +2.47% | +2.11% |

| Seattle, WA | +1.87% | +2.24% | +2.19% |

| San Francisco, CA | +1.57% | +1.63% | +1.93% |

| Dallas, TX | +1.39% | +1.46% | +3.25% |

| Las Vegas, NV | +1.24% | +1.28% | +0.61% |

| Kansas City, MO | +1.08% | +1.26% | +0.64% |

| San Diego, CA | +0.98% | +0.91% | +1.13% |

| Portland, OR | +0.86% | +1.15% | +1.47% |

| Washington, D.C. | +0.84% | +0.88% | -0.12% |

| Atlanta, GA | +0.81% | +0.80% | -0.36% |

| Phoenix, AZ | +0.67% | +0.71% | +0.46% |

| Sacramento, CA | +0.64% | +0.70% | +1.06% |

| Riverside, CA | +0.45% | +0.57% | +0.32% |

| Los Angeles, CA | +0.32% | +0.45% | +0.99% |

| New York, NY | +0.10% | +0.26% | -0.43% |

| Miami, FL | -0.14% | +0.00% | +0.86% |

| Detroit, MI | -0.16% | +0.05% | +0.28% |

| Houston, TX | -0.48% | -0.62% | -0.31% |

| Tampa, FL | -0.65% | -0.68% | -0.01% |

| Baltimore, MD | -1.06% | -1.02% | -2.24% |

| Cleveland, OH | -1.09% | -0.97% | -2.35% |

| Philadelphia, PA | -1.10% | -1.03% | -2.33% |

| Chicago, IL | -2.11% | -2.12% | -1.37% |

(A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.)

Read more...Princeton Mortgage, Finicity Digitize Verifications

- Sunday, 09 December 2018

Princeton Mortgage is working with Finicity to automate borrower asset verification for lenders. The aim is to provide Princeton Mortgage loan officers and borrowers with a faster, simpler loan origination experience that reduces both paper and number of days required to close loans.

Princeton Mortgage’s digital mortgage platform, SnapApp, will leverage Finicity’s verification of assets solution to give lenders access to the data insights they need to streamline the loan application process, reduce mortgage fraud, free up resources and shorten time to close.

Automation can cut the verification process from days to minutes as borrowers no longer need to search for bank statements, and lenders have more time to focus on high-value activities, such as approving more loans.

“We’re thrilled to work with Princeton Mortgage and to provide its customers with an innovative, paper-free and hassle-free experience,” said Steve Smith, CEO at Finicity. “We are always looking for partners who share our goal of transforming outdated loan origination processes into seamless digital experiences.” Finicity delivers real-time financial data aggregation and insights to lenders.

Princeton Mortgage created The Effortless Mortgage to perfect the user experience in loan origination. The solution includes platforms for integrating, managing and securing data to reduce stress and complications in the process for both brokers and borrowers. The Princeton Mortgage SnapApp is a key component to this process as it allows customers to get pre-approved in minutes from their phone, tablet or desktop.

“Borrowers want an effortless mortgage experience, and with our new SnapApp they get just that. Through SnapApp’s automated digital mortgage process, borrowers can apply, verify their income and assets, pull their credit, run an automated approval and even receive a pre-approval letter in the middle of the night, at their convenience,” said Nicole Gordon, sales enablement manager for Princeton Mortgage.

Read more...Stop! Think About This Daily

- Monday, 10 December 2018

[caption id="attachment_7900" align="alignleft" width="300"] Brian Sacks[/caption]

Brian Sacks[/caption]

By Brian Sacks

This is the time of year, we are all making our plans for the upcoming 12 months.

Most of us simply hope that everything will be ok? We hope rates will stay low. We hope the real -estate market will be active. We hope agents will give us business and be loyal.

A Lot of Hoping, Isn’t It?

But deep down inside we all know that hope is not a strategy for success. So, when business is good, we tend to ignore the fact that we must always keep marketing and meeting new referral sources.

But when business slows down, we tend to immediately start looking for all of the magic pills that can generate business for us. Some even look for magic pills outside of our business to generate income.

Sorry to break this to you, but there really aren’t any magic pills.

You must have competitive pricing. You must have good service. You must do a good job.

But those are still not enough to ensure you have a good 12 months and a solid mortgage practice. The bottom line is that you must work hard and smart and consistent.

The Problem with Magic Pills

These so-called solutions come and go. Some work short term and some don’t work at all. But if you are truly going to achieve your goals you must ask yourself one question at the beginning, middle, and end of each day.

Are you ready for the question?

Is what I’m doing right now taking me further toward my goal or not?

We are all bombarded by the magic pill sellers each and every day. So, it’s very easy to get distracted and lose focus. But focus is the key to your success.

Not to sound too cliché but the saying “Plan your work and work your plan” really does hold true in our business. We are all pulled in many directions each day. Trying to get new deals. Trying to form new relationships.

Trying to get the deals we have in process out quickly and smoothly.

Then we get an e-mail or even a phone call with something that really sounds fascinating.

Now, here’s where you need to ask yourself that important question:

Is what I’m doing right now taking me further toward my goal or not?

Let me give you a few examples:

You are due to meet with an agent. Is that person an agent who can provide you with the type and amount of deals you are looking for?

You see an ad or e-mail for a new tool that will generate leads. Will that tool work, and if it does, will it generate shoppers or pre-qualified buyers for the loan sizes and programs you are looking for?

You are asked to join a networking group.

Will the people in that group be able to provide you with leads? Will those leads be the loan size and type you want?

By now I hope you see the issue. Not every opportunity is one you should be acting on. Stop first and ask yourself the question.

Will this take me closer or farther away from my goal?

About the Author

Brian Sacks, a recognized mortgage expert with Homebridge Financial Services Inc., has closed more than $1 billion in loans and 5,890 mortgage transactions. Also, he wrote "48 Proven Ways to Immediately Close More Loans." You can learn more at http://48waysbook.com.