-

The Rise of Green Commercial Lending: A Sustainable Shift in the Market Explore the rise of green commercial lending in the mortgage market, highlighting eco-friendly financing trends and the shift towards sustainability in lending practices.

The Rise of Green Commercial Lending: A Sustainable Shift in the Market Explore the rise of green commercial lending in the mortgage market, highlighting eco-friendly financing trends and the shift towards sustainability in lending practices.

matt

UWM Promises the Lowest Rates in the Industry

- Monday, 07 January 2019

United Wholesale Mortgage will begin to provide mortgage brokers with the best rates and pricing in the U.S.

According to the company, it has been competitive in terms of rates, regularly ranking near the top of most rate comparisons, but was recognized by mortgage brokers more for its service, process, technology and partnership tools—and not for having the lowest rates.

"Perception has always been that a lender can't deliver it all: the best service, great technology, a true partnership, and have the best pricing too, but now they can have it all," said Mat Ishbia, president and CEO of United Wholesale Mortgage. "If a mortgage broker has a borrower with a 640 FICO [or higher], it should be a UWM loan."

To be able to offer the best rates, it has removed all state adjustments and many loan-level price adjustments, offering the best pricing on every loan with a 640 FICO and higher, according to the company.

These pricing improvements follow other recent pricing initiatives, such as the Jumbo Bank Buster program, which UWM contends offers the cheapest jumbo rates, and its lower borrower-paid mortgage insurance rates.

UWM finished 2018 with $41.5 billion in total loan volume, an all-time high for the company, and a 25% market share. That’s a sales increase of 40% compared with 2017. Also, UWM is the No. 1 non-bank purchase lender in the country and No. 4 the top-producing mortgage lenders overall in the U.S.

Read more...Will the Government Shutdown Lead to Origination Delays?

- Tuesday, 08 January 2019

The effects of the federal government shutdown on the housing market are wide-ranging and personal--unpaid workers still have to pay their mortgage, while aspiring homeowners might see their loans in limbo.

[caption id="attachment_8411" align="alignright" width="289"] The government shutdown could delay loan closings, according to Zillow.[/caption]

The government shutdown could delay loan closings, according to Zillow.[/caption]

About 800,000 workers aren't being paid, about 380,000 are furloughed and another 420,000 are working without pay, and still must find ways to pay for their housing as the shutdown heads into its third week, according to Zillow. Zillow. Federal employees who are not being paid during the shutdown and own their homes pay an estimated $249 million in mortgage payments each month.

Also, the Federal Housing Administration is operating with limited staff and warns that endorsement of loans may be delayed. That could mean some loans don't close, as that decision depends on the flexibility of individual lenders, leaving buyers unable to complete their purchase. Many lower-income or first-time buyers opt for the FHA insured loans because they often allow for smaller down payments and offer more forgiving credit-score requirements than conventional loans.

An estimated 3,900 mortgage originations are processed each business day backed by federal government agencies, such as the Federal Housing Administration and the Rural Housing Service. It isn't clear what portion of those are delayed, or for how long, because of the limited staff during the shutdown. When those loans are delayed, it most affects those with the greatest hurdles to become homeowners. FHA won't insure reverse mortgages or home-improvement loans during the shutdown.

The Department of Housing and Urban Development does not expect a significant impact as long as the shutdown is brief. But "with each day the shutdown continues, we can expect an increase in the impacts on potential homeowners, home sellers and the entire housing market," the agency says.

In addition, the shutdown could lead to administrative delays associated with loans backed by Fannie Mae and Freddie Mac, two independent agencies that insure the vast majority of mortgages. Those include lenders unable to get verification of employment for borrowers who are federal employees, and potential IRS delays verifying borrower incomes, which could lead to loans being denied.

"Like Americans in the private sector, many federal employees rely every paycheck to cover critical expenses, including housing," said Zillow’s senior economist Aaron Terrazas. "It also could have a significant impact on the overall housing market if it continues to drag on and furloughed workers who also are would-be buyers get cold feet in the absence of paychecks. Buying a home is a huge leap of faith for many, as they bet on continued job security and steady income to finance their home, and consumer confidence is paramount."

Read more...Gen-Xers, Older Millennials Prefer Stocks to Real Estate

- Sunday, 06 January 2019

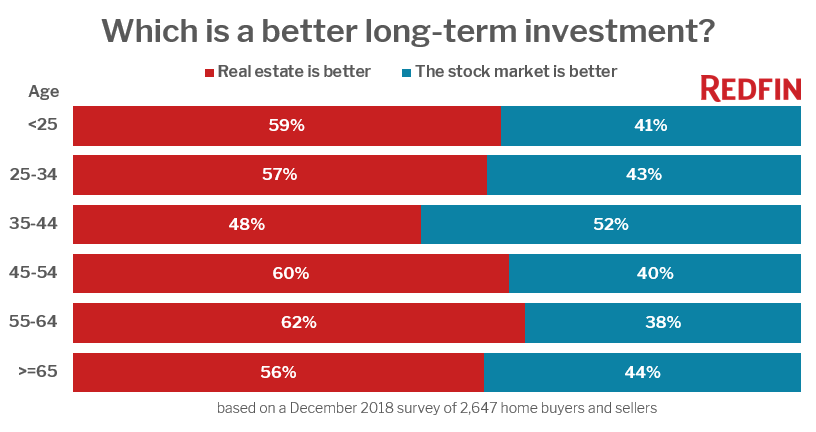

Less than half of homebuyers and sellers between the ages of 35 and 44 believe that real estate is a better long-term investment than the stock market, according to a survey from Redfin, a real estate brokerage.

Buyers who reached the median first-time homebuyer age of 31 years old between 2008 and 2012 during the Great Recession and housing market collapse are now 37 to 41 years old. This is the only age group that has less confidence in real estate as an investment than the stock market. Just 48 percent of homebuyers and sellers in this age group believe that real estate is a better long-term investment than the stock market.

"The oldest Millennials and youngest Gen-Xers entered their late twenties or early thirties during the housing crash, which explains why they are more skeptical about investing in real-estate," said Redfin’s chief economist Daryl Fairweather. "This generation experienced a major setback during the housing bust, which hit just as they were most likely to be getting married, starting a family, and becoming a first-time homeowner. Looking into the future, we expect to see homeownership increase as Millennials enter prime home-buying age. This is because Millennials have a more favorable opinion of real estate as an investment than Gen-Xers, and Millennials are a larger group than Gen-Xers."

"The oldest Millennials and youngest Gen-Xers entered their late twenties or early thirties during the housing crash, which explains why they are more skeptical about investing in real-estate," said Redfin’s chief economist Daryl Fairweather. "This generation experienced a major setback during the housing bust, which hit just as they were most likely to be getting married, starting a family, and becoming a first-time homeowner. Looking into the future, we expect to see homeownership increase as Millennials enter prime home-buying age. This is because Millennials have a more favorable opinion of real estate as an investment than Gen-Xers, and Millennials are a larger group than Gen-Xers."

In every other age group, buyers and sellers who believe that real estate is a better long-term investment outnumbered those who believe the stock market is better. Younger Baby Boomers, respondents aged 55 to 64, were the most optimistic about real estate as an investment.

In December 2018, Redfin surveyed more than 2,600 people nationwide who at the time bought or sold a home in the last year, attempted to do so, or had plans to buy or sell in the near future.

Read more...