-

Navigating the Complex Landscape of Commercial Lending: Recent Trends and Insights Explore recent trends and insights in commercial lending, including increased demand, sustainability focus, and digital transformation impacting lenders and borrowers in the current market.

Navigating the Complex Landscape of Commercial Lending: Recent Trends and Insights Explore recent trends and insights in commercial lending, including increased demand, sustainability focus, and digital transformation impacting lenders and borrowers in the current market.

MBA: Apps Up 5.3%

- Tuesday, 26 February 2019

- Lending

Mortgage applications increased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Feb. 22, 2019. This week’s results include an adjustment for the Washington's Birthday (Presidents’ Day) holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 5.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the index decreased 3 percent compared with the previous week. The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago.

“Mortgage rates were little changed last week, but as we anticipated, homebuyers are responding favorably to this more stable rate environment,” said Mike Fratantoni, senior vice president and chief economist at the MBA. “Purchase applications for both conventional and government loans rose last week, with the government gain led by a 14 percent increase in applications for Veterans Affairs purchase loans. Refinance application volume increased as well, with the index reaching its highest level in a month. Borrowers with larger loans tend to be more responsive for a given drop in rates, and competition for these loans is fierce. Therefore, it was not surprising to see the average rate for a 30-year fixed jumbo loan drop to its lowest level since January 2018.”

The refinance share of mortgage activity decreased to 40.4 percent of total applications from 41.7 percent the previous week. The adjustable-rate mortgage share of activity decreased to 7.3 percent of total applications.

The FHA share of total applications remained unchanged from 10.2 percent the week prior. The Veterans Affairs share of applications increased to 10.7 percent, from 10.1 percent the week prior. The Department of Agriculture share of applications decreased to 0.6 percent from 0.7 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.65 percent from 4.66 percent, with points remaining unchanged at 0.42 (including the origination fee) for 80 percent loan-to-value ratio loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350) decreased to 4.40 percent from 4.56 percent, with points increasing to 0.29 from 0.23 (including the origination fee) for 80 percent loan-to-value ratio loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the Federal Housing Administration decreased to 4.64 percent from 4.68 percent, with points decreasing to 0.48 from 0.58 (including the origination fee) for 80 percent loan-to-value loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.00 percent from 4.04 percent, with points decreasing to 0.38 from 0.44 (including the origination fee) for 80 percent loan-to-value loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 adjustable rate mortgages decreased to 3.95 percent from 4.00 percent, with points increasing to 0.4 from 0.24 (including the origination fee) for 80 percent loan-to-value loans. The effective rate increased from last week.

Read more...

Ocwen Reports $70.8M Loss for 2018

- Wednesday, 27 February 2019

- Lending

Ocwen Financial Corp. reported a net loss of $70.8 million, or $0.53 per share, for the full year 2018 compared to a net loss of $128 million, or $1.01 per share, for the full year of 2017, a $57.2 million improvement.

For the three months ended Dec. 31, 2018, Ocwen reported a net loss of $2.3 million, or $0.02 per share.

“We made solid progress in the quarter as we work to realize the scale and cost savings benefits of combining Ocwen and PHH and position the Company for future profitability,” said Glen A. Messina, president and CEO of Ocwen. “We are focused on executing our key business initiatives in order to address our most critical near-term business challenges, improve our financial performance, and establish a stronger foundation for the future. We continue with our disciplined and prudent approach to our integration efforts and are encouraged by the overall progress we are making.”

[adbutler zone_id="326314"]

[adbutler zone_id="325889"]

Pre-tax loss from continuing operations for the fourth quarter of 2018 was $7.8 million and included a PHH post- acquisition pre-tax loss of $31.5 million. Pre-tax results for the quarter were impacted by a number of significant items, including but not limited to: $64.0 million in bargain purchase gain, $16.4 million in PHH transaction, integration and restructuring costs and $10.1 million in expense related to significant litigation and regulatory settlements.

The Servicing segment recorded $40.6 million of pre-tax loss for the fourth quarter of 2018 and included a PHH post-acquisition pre-tax loss of $21.2 million. The business was negatively impacted by lower revenue from a smaller servicing portfolio due to portfolio runoff and de-boarding of previously announced subservicing clients as a result of terminations and transfers. For the full year 2018, the Servicing business recorded $31.9 million of pre-tax loss.

The lending segment recorded $3.0 million of pre-tax income for the fourth quarter of 2018. Our forward lending business incurred a $5.3 million pre-tax loss that included a PHH post-acquisition pre-tax loss of $2.4 million. Our reverse mortgage lending business recorded pre-tax income of $8.3 million.

The lending businesses were $5.1 million favorable to prior quarter largely driven by favorable valuation changes on our reverse mortgage lending portfolio as a result of falling interest rates. For the full year 2018, the lending business recorded pre-tax income of $11.2 million, an increase of $15.6 million versus 2017. The forward lending business had a pre-tax loss of $9.2 million, which was more than offset by $20.3 million of pre-tax income in our reverse mortgage lending business.

Additional Business Highlights

- In 2018, Ocwen completed 39,545 loan modifications to help struggling families stay in their homes, 17% of which included debt forgiveness totaling over $200 million.

- Delinquencies decreased from 7.8% at September 30, 2018 to 4.9% at December 31, 2018, primarily driven by acquisition of lower delinquency PHH portfolio and ongoing consumer assistance efforts.

- The constant pre-payment rate (“CPR”) decreased from 13.7% in the third quarter of 2018 to 12.9% in the fourth quarter of 2018. In the fourth quarter of 2018, the prime CPR was 14.8%, and the non-prime CPR was 11.8%.

- For the full year 2018, Ocwen originated forward and reverse mortgage loans with UPB of $0.9 billion and $0.6 billion, respectively. The Company intends to re-enter the correspondent forward lending channel and successfully launched a proprietary jumbo reverse mortgage pilot program.

- Our reverse mortgage portfolio ended the year with an estimated $68.1 million in discounted future gains from future draws on existing loans. Neither the anticipated future gains nor future funding liability are included in the company’s financial statements.

Read more...

Mortgages Rates Continue Dropping

- Wednesday, 20 February 2019

- Lending

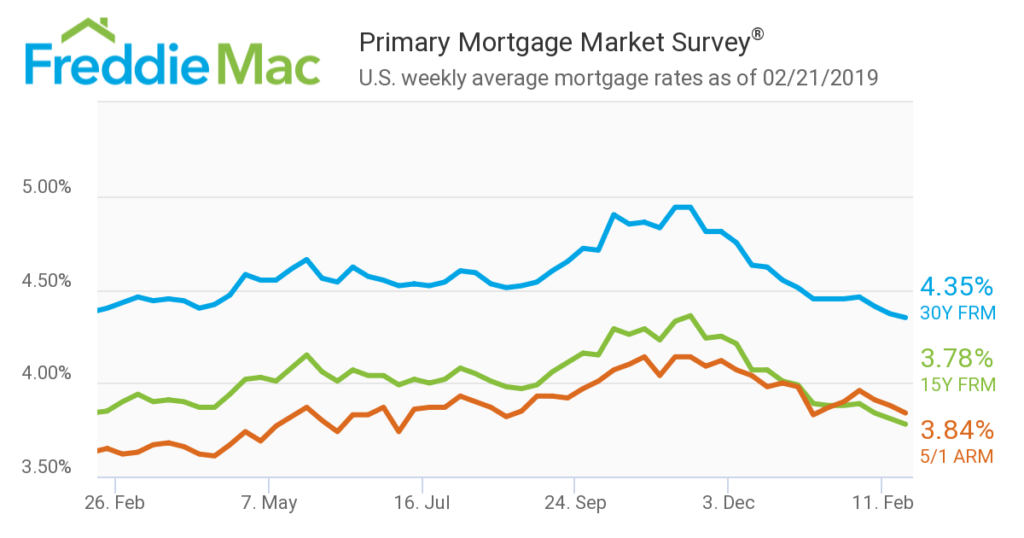

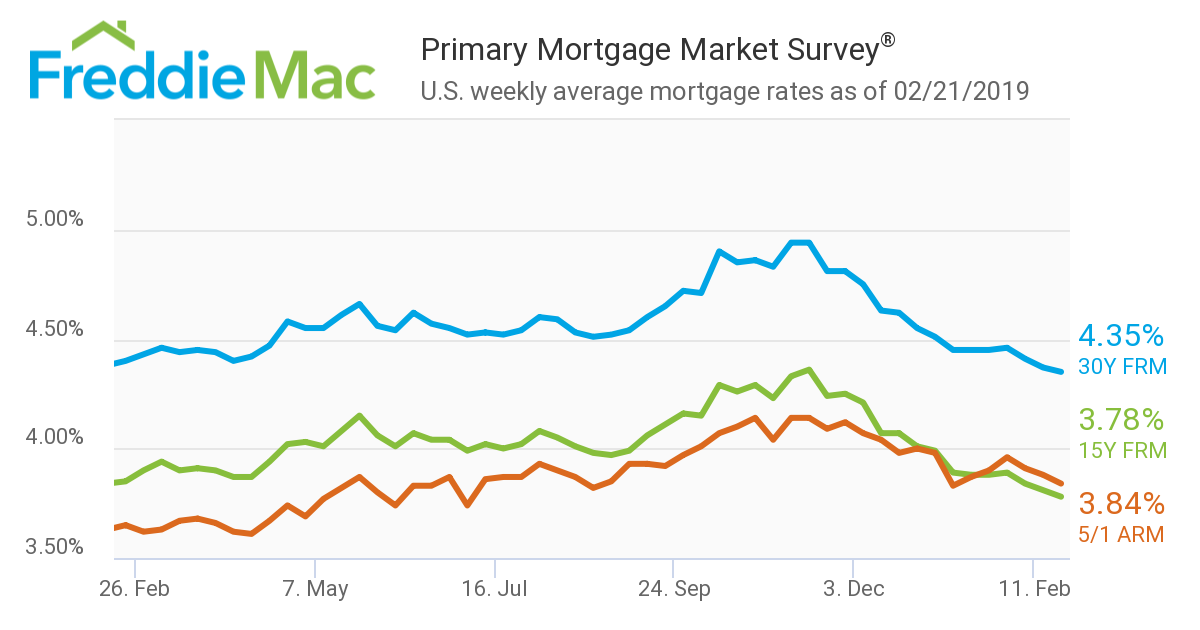

Mortgages rates continue to drop, according to Primary Mortgage Market Survey from Freddie Mac.

“Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year,” said Sam Khater, Freddie Mac’s chief economist. “Wages are growing on par with home prices for the first time in years, and with more inventory available, spring home sales should help the market begin to recover from the malaise of the last few months.”

- The 30-year fixed-rate mortgage averaged 4.35 percent with an average 0.5 point for the week ending Feb. 21, 2019, down from last week when it averaged 4.37 percent. A year ago, the 30-year fixed-rate mortgage averaged 4.40 percent.

- The 15-year fixed rate mortgage this week averaged 3.78 percent with an average 0.4 point, down from last week when it averaged 3.81 percent. A year ago, the 15-year fixed-rate mortgage averaged 3.85 percent.

- The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84 percent with an average 0.3 point, down from last week when it averaged 3.88 percent. A year ago, the 5-year adjustable-rate mortgage averaged 3.65 percent.

Average commitment rates are reported along with average fees and points to reflect the upfront cost of obtaining the mortgage.

Read more...

Homeowners’ Equity Rises 9.4%

- Monday, 10 December 2018

- Lending

Homeowners with mortgages have seen their equity increase 9.4 percent year over year, a gain of almost $775.2 billion since the third quarter of 2017.

Also, the average homeowner gained $12,400 in home equity between the third quarter of 2017 and the third quarter of 2018, according to the Home Equity Report from Corelogic.

While home equity grew in almost every state in the nation, western states experienced the most significant increases. California homeowners gained an average of around $36,500 in home equity, and Nevada homeowners experienced an average increase of approximately $32,600 in home equity.

From the second quarter of 2018 to the third quarter of 2018, the number of homes with negative equity decreased 4 percent to 2.2 million homes, or 4.1 percent of all mortgaged properties. Year over year, the number of mortgaged properties in negative equity fell 16 percent from 2.6 million homes, or 5 percent of all mortgaged properties, in the third quarter of 2018. Fully 63% of Homeowners have a mortgage.

“On average, homeowners saw their home equity increase again this quarter but not nearly as much as in previous quarters,” said Dr. Frank Nothaft, chief economist for CoreLogic. “During the third quarter, homeowners gained an average of $12,400 compared to the second quarter when the average home equity wealth increase was more than $16,000. This lower year-over-year gain reflects the slowing in appreciation we’ve seen in the CoreLogic Home Price Index.”

[caption id="attachment_7571" align="alignleft" width="294"] Negative equity has declined year over year.[/caption]

Negative equity has declined year over year.[/caption]

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth.

Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both. Negative equity peaked at 26 percent of residential properties with a mortgage in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

The national aggregate value of negative equity was around $281.6 billion at the end of the third quarter of 2018. This is down year over year by approximately $2.7 billion, from $279 billion in the third quarter of 2017.

“The number of homes in a negative equity position have remained around 2.2 million for two consecutive quarters this year,” said Frank Martell, president and CEO of CoreLogic. “Without equity, those homeowners are unable to sell their homes and are more likely to transition from delinquency to foreclosure if they face financial distress.”

Read more...