OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

The mortgage leader

Sham Short Sale Conspiracy Brings Down Real Estate Attorney, Two Others

- Thursday, 12 July 2018

A real-estate attorney was sentenced today in connection with a sweeping conspiracy to defraud banks and mortgage companies by engaging in sham short sales of residential properties in Merrimack Valley, Mass., near Boston.

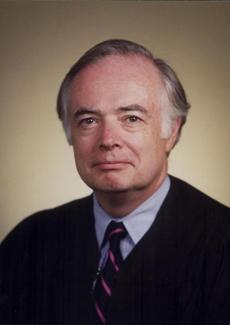

Jasmin Polanco, 37, of Methuen,Mass., was sentenced by Douglas Woodlock, senior district court judge, to 15 months in prison, three year of supervised release and ordered to pay $1.2 million in restitution. In March 2018, Polanco pleaded guilty to one count of conspiracy to commit bank fraud.

[caption id="attachment_5419" align="alignleft" width="157"] Douglas Woodlock

Douglas Woodlock

Senior District Court Judge[/caption]

Co-defendants Vanessa Ricci, 41, also of Methuen, a mortgage loan officer, pleaded guilty in March 2018 to one count of conspiracy to commit bank fraud and was sentenced to six months in prison, three years of supervised release and ordered to pay restitution of $963,730. Greisy Jimenez, 50, Methuen, a real-estate broker, pleaded guilty to two counts of bank fraud and one count of conspiracy to commit bank fraud and is awaiting sentencing. Hyacinth Bellerose, 51, of Dunstable,Mass., a real estate closing attorney, was sentenced in March 2017 to time served and one year of supervised release to be served in home detention after pleading guilty to conspiracy to commit bank fraud. The conspiracy began in approximately August 2007 and continued through June 2010, a period that included the height of the financial crisis and its aftermath.

The charges arose out of a scheme to defraud various banks through bogus short sales of homes in Haverhill, Mass., and Lawrence, Mass., as well as Methuen in which the purported sellers remained in their homes with their debt substantially reduced. A short sale is a sale of real estate for less than the value of the existing mortgage on the property.

Short sales are an alternative to foreclosure that typically occur when the mortgage lender consents; the lender absorbs a loss on the loan and releases the borrower from the unpaid balance. By their very nature, short sales are intended to be arms-length transactions in which the buyers and sellers are unrelated, and in which the sellers cede their control of the subject properties in exchange for the short-selling bank’s agreement to release them from their unpaid debt.Home values in Massachusetts and across the nation experienced a significant decline, and many homeowners found themselves with homes worth less than the mortgage debt they owed.

As part of the scheme, Polanco, Jimenez, Ricci, Bellerose and others submitted materially false and misleading documents to numerous banks in an effort to induce them to permit the short-sales, thereby releasing the purported sellers from their unpaid mortgage debts, while simultaneously inducing the purported buyers’ banks to provide financing for the deals. In fact, the purported sellers simply stayed in their homes, with their debt substantially reduced.

The conspirators led banks to believe that the sales were arms-length transactions between unrelated parties, which was false; in fact, the buyers and sellers were often related, and the sellers retained control of (and frequently continued to live in) the properties after the sale. The conspirators also submitted phony earnings statements in support of loan applications that were submitted to banks in order to obtain new financing for the purported sales.

In addition, the defendants submitted phony “HUD-1 Settlement Statements” to banks that did not accurately reflect the disbursement of funds in the transactions. (HUD-1 Settlement Statements are standard forms that are used to document the flow of funds in real estate transactions, and they are required for transactions involving federally related mortgage loans, including all mortgages insured by the Federal Housing Administration.

United States Attorney Andrew E. Lelling; Christina Scaringi, Special Agent in Charge of the Department of Housing and Urban Development, Office of Inspector General, New York Field Office; and Christy Goldsmith Romero, Special Inspector General of the Troubled Asset Relief Program, made the announcement. Assistant U.S. Attorney Stephen E. Frank, Chief of Lelling’s Economic Crimes Unit, and Assistant U.S. Attorneys Sara Miron Bloom and Victor A. Wild, also of the Economic Crimes Unit, prosecuted the cases.

Read more...Freddie Mac: Mortgage Rates Drop Significantly

- Friday, 11 January 2019

Mortgage rates have dropped significantly across the board, according to the “Primary Mortgage Market Survey” from Freddie Mac.

“Mortgage rates fell to the lowest level in nine months, and in response, mortgage applications jumped more than 20 percent,” said Sam Khater, Freddie Mac’s chief economist. “Lower mortgage rates combined with continued income growth and lower energy prices are all positive indicators for consumers that should lead to a firming of home sales.”

Additional takeaways on rates are as follows:

• The 30-year fixed-rate mortgage averaged 4.45 percent with an average 0.5 point for the week ending Jan. 10, 2019, down from last week when it averaged 4.51 percent. A year ago at this time, the 30-year fixed-rate mortgage averaged 3.99 percent.

• The 15-year fixed-rate mortgage averaged 3.89 percent with an average 0.4 point, down from last week when it averaged 3.99 percent. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.44 percent.

• The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.83 percent with an average 0.3 point, down from last week when it averaged 3.98 percent. A year ago at this time, the 5-year adjustable rate mortgage averaged 3.46 percent

Walker and Dunlap Hire Industry Vet for Multifamily Finance Group

- Thursday, 12 July 2018

Walker and Dunlap has hired John Gilmore as SVP and managing director in its multifamily finance group. He is focused on the affordable multifamily space and has extensive experience sourcing loans for execution through Fannie Mae, Freddie Mac, and the Department of Housing and Urban Development. Gilmore will drive multifamily loan origination growth in one of the most important rental housing markets in the country.

"John has over a decade of experience managing dynamic real estate portfolios and developing new client opportunities," said Walker and Dunlop Executive Vice President, Don King. "He has played a number of critical roles in the affordable rental housing space and will add tremendous value to our already great lineup of multifamily bankers and brokers. "

[adbutler zone_id="326321"]

Prior to joining Walker and Dunlop, Gilmore was a VP and senior relationship manager in the Community Development and Investment group within KeyBank Real Estate Capital. While at KeyBank, he was a member of the management team that expanded the bank's affordable housing activity to all 50 states. In this position he originated almost $1 billion of new mortgage debt. Mr. Gilmore is also very experienced in complex deal structures including structured credit facilities, tax-exempt bonds, and federal and state tax credits.

Read more...