-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

matt

Volume of Enotes Surge: Merscorp

- Monday, 15 April 2019

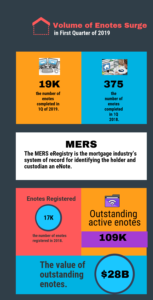

The number of enotes that have been added to the MERS eRegistry during the first quarter of 2019 exceeded the number of enotes registered for all of 2018, according to Merscorp Holdings Inc.

The number of enotes that have been added to the MERS eRegistry during the first quarter of 2019 exceeded the number of enotes registered for all of 2018, according to Merscorp Holdings Inc.

MERS member institutions, including lenders and originators, registered around 19,000 enotes in the first quarter of 2019, compared to the 17,000 enotes registered in all of 2018. In comparison, the number of enotes registered in the first quarter of 2018 was 375.

This also increases the number of outstanding active enotes to 109,000, or $28 billion of residential mortgages. The rapid growth of eNotes is a key indicator that the residential lending industry continues to drive toward digitization of the production process.

“As the industry continues to migrate toward a fully-digital process, the early movers gain efficiencies and can remain most competitive in the market,” said Christopher McEntee, president of ICE Mortgage Services. “We’re excited about the rapid adoption of enotes, and we expect to see a continual rise as more participants invest in next generation infrastructure.”

Enotes are an essential component of a digital mortgage strategy, as they do not require notarization, are enforceable in all 50 states, and easily integrate into an electronic closing process that improves the consumer experience and lowers lenders’ costs. Merscorp Holdings Inc. is a subsidiary of the Intercontinental Exchange.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

The MERS eRegistry is the mortgage industry’s system of record for identifying the controller and location of the authoritative copy of an eNote, or who in the traditional paper world of mortgages, is the legal holder of the original note. This gives consumers, lenders, and investors the confidence to move toward a digital process because authenticity of electronic copies can be verified by an independent third-party.

Read more...

Report: 161K Properties Filed for Foreclosure in Q1

- Wednesday, 10 April 2019

There were 161,875 U.S. properties with a foreclosure filing during the first quarter of 2019, down 23 percent from the previous quarter and down 15 percent from a year ago, to the lowest level since Q1 2008, according to the Q1 2019 U.S. Foreclosure Market Report from Attom Data Solutions.

The report shows 58,550 U.S. properties with foreclosure filings in March 2019, up 7 percent from the previous month but down 21 percent from a year ago—the ninth-consecutive month with a year-over-year decrease in U.S. foreclosure activity.

"While some markets saw a slight uptick in foreclosure filings, that is above pre-recession levels, the majority of the major markets are well below pre-recession levels," said Todd Teta, chief product officer at Attom Data Solutions. "While we did see a slight increase in U.S. foreclosure starts from last quarter, bank repossessions reached an all-time low in the first quarter of 2019, showing continuing signs of a strong housing market."

The 132 out of the 220 markets (60 percent) with a population greater than 200,000 in the first quarter foreclosure activity below pre-recession averages included San Jose (79 percent below); Memphis (77 percent below); Dallas-Fort Worth (77 percent below); Las Vegas (74 percent below); and Phoenix (68 percent below).

Other major markets with first quarter foreclosure activity below pre-recession averages were San Francisco, Riverside-San Bernardino in Southern California, Chicago, Detroit and Seattle.

Markets still above pre-recession levels include Baltimore, Washington D.C., Philadelphia. In 88 out of the 220 markets analyzed (40 percent), first quarter foreclosure activity levels were still above pre-recession averages, including Baltimore (189 percent above); Washington D.C. (26 percent above); Philadelphia (20 percent above); New York (13 percent above); and Hartford (4 percent above).

Other major markets with first quarter foreclosure activity above pre-recession averages included Richmond, Virginia; Virginia Beach, Providence, Rhode Island; and New Orleans.

Lenders started the foreclosure process on 91,397 U.S. properties in Q1 2019, up 7 percent from the previous quarter but down 3 percent from a year ago—the 15th consecutive quarter with a year-over-year decrease in foreclosure starts.

Counter to the national trend, 15 states posted year-over-year increases in foreclosure starts in Q1 2019, including Florida (up 65 percent); Georgia (up 30 percent); Texas (up 27 percent); Louisiana (up 20 percent); Washington (up 12 percent); and Maryland (up 11 percent).

Lenders repossessed 35,787 U.S. properties through foreclosure (REO) in Q1 2019, down 21 percent from the previous quarter and down 45 percent from a year ago — the 14th consecutive quarter with a year-over-year decrease in U.S. REOs.

Along with the District of Columbia, 48 states posted year-over-year decreases in REOs in the first quarter, including Arizona (down 77 percent); California (down 41 percent); Florida (down 33 percent); New Jersey (down 59 percent); and Texas (down 43 percent).

Read more...

Golden State Lender Implements Digital Lending Technology

- Wednesday, 10 April 2019

Mountain West Financial has rolled out an online borrower portal.

The digital lending platform from Lender Price is a borrower engagement platform that automates and streamlines the mortgage-loan-application process.

“Our borrowers want a convenient and easy to use way to engage with us online,” said Mike Douglas, CEO of California-based Mountain West Financial, a retail and wholesale mortgage lender. “The reason we chose Lender Price is because their platform gave us the flexibility to create a process that doesn’t have a lot of ‘fluff'. We built an efficient workflow that encourages borrowers to complete the application while also ensuring that information was captured in our LOS in real-time.”

The integration between digital lending platform and Mountain West’s loan-origination system provides borrowers visibility throughout the entire origination process. Loan status updates, document uploads and even pricing engine access were built into the LOS integration.

"Our borrowers are happier and it’s a tremendous time saver for our loan officers,” said Douglas. “We’ve rolled out to more than 150 loan officers across 30 branches and it’s been extremely successful for us. We know this is going to transform the way we do business.”

The platform integrates with loan-origination systems to create a seamless environment between the borrower, loan officer and the operations staff, resulting in a smoother, more transparent and faster mortgage closing process.

Digital lending platform features digital verification services for assets, employment and credit reports, which intelligently fill out loan application data and drive more complete and accurate borrower submissions. DLP provides intuitive tools that allow mortgage lending institutions to create their own borrower experience without any technical know-how.

“Our clients include several large banks and mortgage lenders that insist on controlling the borrower experience,” said Dawar Alimi, CEO of Lender Price. “We built tools that are specifically designed for non-technical people to create complex workflows within [digital lending platform]. By giving our clients both the flexibility and control they want, we’re providing a sustainable platform because it can change and adapt to their needs over time."

Read more...