-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

matt

Fidelity National Launches Digital Title Closing Capability

- Tuesday, 19 March 2019

Fidelity National Financial has launched its digital title closings capability.

Developed in partnership with Black Knight Inc. this new closing experience supports both hybrid and digital closing options and is integrated with FNF's title production systems. Designed to digitally engage homebuyers and sellers in the process well in advance of the closing signature ceremony, the experience brings increased transparency, flexibility and convenience to the final steps of real estate transactions.

"Today's homebuyers and sellers have come to expect a digital experience that increases the transparency and convenience of the transaction," said Jason Nadeau, chief digital Officer for Fidelity National Financial. "At FNF, we understand this. That's why we're committed to creating a totally redesigned real estate experience for the consumer. We're also making sure our vast network of partners has access to the tools they need to compete effectively in an increasingly digital world."

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

In partnership with Black Knight and leveraging the company's Expedite Close technology, FNF created a digital closing experience that is tailored to meet the very specific needs of the settlement community. FNF's platform is based upon tight integrations with title production and workflow solutions and optimized for ease of use and maximum adoption. Also, consumers are provided with greater visibility and transparency into their documents prior to the actual closing. Integrated eSignature technology allows for many documents to be signed in advance of the closing itself and – in jurisdictions where it is permitted – remote online notarization capabilities ensure sellers and buyers can close on a real estate transaction when and where it best suits their schedules.

"We're honored to have collaborated with FNF in developing a new closing experience," said Joe Nackashi, president of Black Knight. "Black Knight is committed to our clients' success, and we wholeheartedly support FNF's mission to redefine the experience for the millions of consumers they work with annually."

While the digital closing platform is loan origination system agnostic, it is integrated with Black Knight's suite of solutions. FNF's title operations will begin leveraging the digital closing platform in in the second quarter of 2019.

Read more...

Kroll: M&A Deals Are Slow to Materialize

- Wednesday, 20 March 2019

Although the time is ideal for mergers and acquisitions between mortgage lenders there was just one large deal and a handful of small deals.

The BB&T Corp.’s acquisition of SunTrust Banks Inc. creates the ninth largest mortgage lender in the U.S. with a 2.3 percent market share, according to the “Residential Mortgage Bank Update” from the Kroll Bond Rating Agency. For the combined entities, residential mortgages are expected to represent 27 percent of total loans and comprise 7 percent of fee income. SunTrust’s pre-merger market share was 1.4 percent.

Across the mortgage industry, deal activity has been slower than expected as acquirers are being selective, and sellers are reluctant to entertain deals at lower valuations. With production profits down and the average cost per loan over $8,000, banks are taking a serious look at the viability of mortgage lending as a product offering, in particular traditional retail. Some banks are simply exiting mortgage-lending activities but have decided to sell mortgage-related assets.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

For example, TIAA Bank is transitioning out of retail branch home lending to focus on digital loan originations. Also, U.S. Bank will extend offers to experienced loan officers and assume leases on offices in key markets and took over 26 TIAA branches.

Provident Savings Bank, a privately held California thrift, closed its residential mortgage operation last month due to difficult market conditions.

HomeStreet Inc. has reached a non-binding letter of intent with Homebridge Financial Services,Inc., under which Homebridge would acquire HomeStreet’s home loan centers and hire its employees. The deal reflects HomeStreet’s acceptance of the fact that near-term recovery of origination volume and profitability might not happen. HomeStreet will continue to offer mortgages through the branch network and focus on increasing retail deposits.

Based on 2018 origination volumes, the transaction could make Homebridge to a top-20 mortgage lender in 2019.

Read more...3 Reasons for Increased Price Disparity Based on Credit Scores

- Monday, 18 March 2019

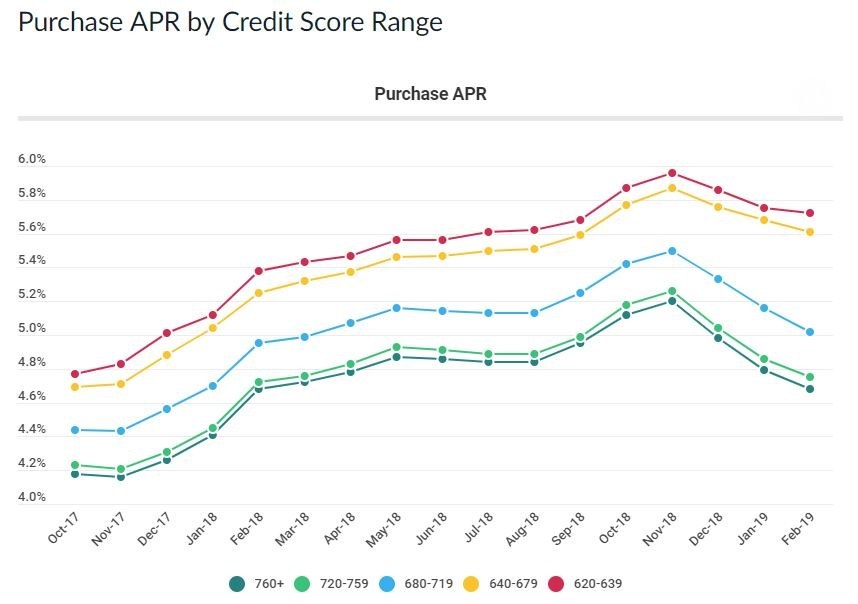

In LendingTree’s recently released Mortgage Offers Report, which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree's network, the data suggests that borrowers with lower credit scores aren’t realizing the full benefit of declining interest rates.

"Of note, since rates started falling in December, lenders are passing through those benefits to higher credit borrowers, but not so much to lower credit borrowers," said Tendayi Kapfidze, chief economist at LendingTree. "You can see in the chart that tracks annual percentage rate by credit score, the top two lines representing lower credit scores have not moved down much.”

"Of note, since rates started falling in December, lenders are passing through those benefits to higher credit borrowers, but not so much to lower credit borrowers," said Tendayi Kapfidze, chief economist at LendingTree. "You can see in the chart that tracks annual percentage rate by credit score, the top two lines representing lower credit scores have not moved down much.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

In fact, borrowers with scores of 760 plus have seen a decline of 52 basis points, but those with scores of 620 to 639 realized just 24 bps from November to February.

“A lot of the difference is being driven by risk. Many of the lower credit score and non-QM loans come in with exceptions. These exceptions are adding another quarter point almost every time” said Carl Markman, director of national sales at REMN.

One of the things driving the higher pricing for the borrowers with lower credit scores seems to be risk layering. According to a recent Federal Housing Administration, there is an increasing concentration of loans that have both credit scores below 640 and debt to income ratios above 50 percent. This has led to the FHA making changes to it’s Technology Open to Approved Lenders Mortgage Scorecard system that reinstates manual underwriting requirements for certain mortgages with credit scores below 620 and debt to income ratios above 43 percent.

When Fannie increased the maximum debt to income to 50 percent from 45 percent in an update to Desktop Underwriter last year. It brought the limit in line with competitor Freddie Mac, removed maximum loan-to-value ratios and minimum reserves requirements for those loans.

But, after examining the loans, it received since last year's update, Fannie implemented some fine tuning that would limit that risk layering.

“Operational costs are also playing a role. Borrowers with non-QM and lower credit scores often take more hand holding and more documentation,” said Markman. “These operational costs have to be factored into the pricing.”

A third reason why the lower credit score pricing hasn’t fallen as fast as the upper ranges is because the non-QM loans are very investor specific. They offer specialized pricing for specialized products which can’t be shopped around as easily in the secondary market.

This decreased level of commoditization allows private-label securitizers to look for yield. Pricing on the lower credit score loans is often changed only a handful of times a month. “These loans are sticky on the way down and sticky on the way up,” said a long-time industry executive, who declined to be named because he isn't an approved company spokesperson.

Read more...