-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

matt

HELOC Customers Crave Alternative Funding Sources, Digital Offerings

- Thursday, 14 March 2019

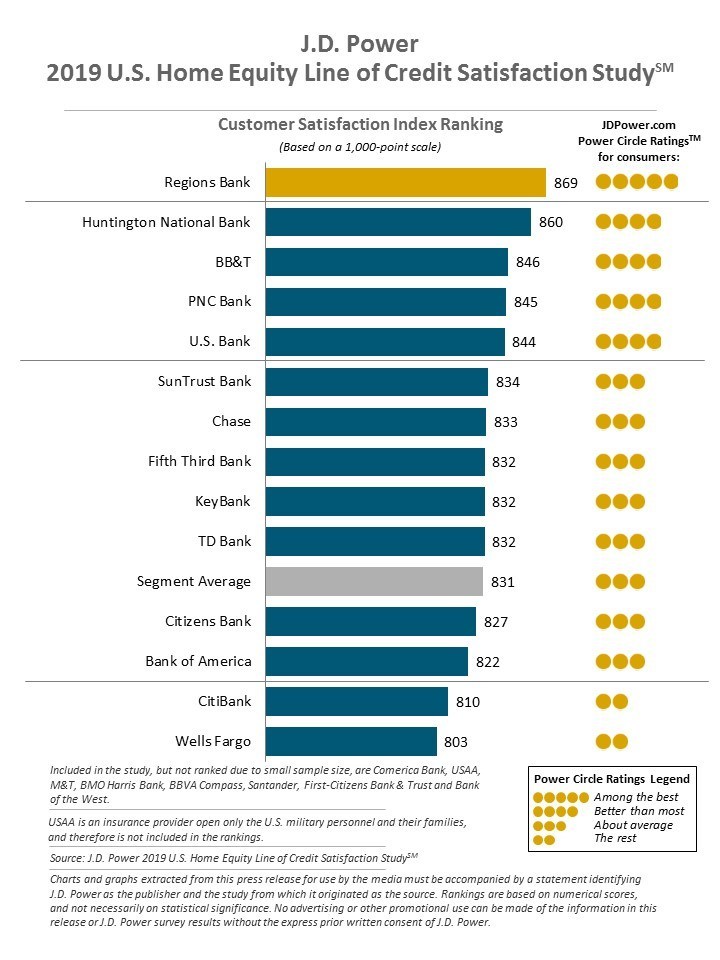

HELOC customers are more likely than ever to shop for alternative sources of funding and lenders are falling short on digital offerings, according to the “J.D. Power 2019 U.S. Home Equity Line of Credit Satisfaction Study.”

"HELOC providers have a privileged position in the consumer lending space by virtue of the relationships they already have with home loan customers, but they cannot afford to rely on those relationships alone to generate new originations," said John Cabell, Global Business Intelligence Practice Leader at J.D. Power. "Customers are being wooed by increasingly sophisticated competitors. Right now, HELOC providers are struggling to deliver digital experiences that are in line with customer expectations. That is becoming a major drag on future business as new, digital-native competitors enter the marketplace."

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Following are key findings of the 2019 study:

- Alternative lenders pose bigger threat:Two-thirds of new HELOC customers who obtained their line of credit within the past two years considered alternative products when shopping for their HELOC, a figure that is up from 41% just a few years ago. Likewise, younger HELOC customers (under 40 years old) are far more likely to consider alternative products. On average, these customers consider 2.5 different loan products, including personal loans, credit cards and cash advances.

- HELOC providers missing the mark on digital:Despite rising use and satisfaction with digital channels in virtually every other aspect of retail banking, satisfaction is lowest among HELOC customers who gather information entirely online (819 on a 1,000-point scale) vs. those who gather information in person or via phone only (836) and those who used both online and in-person channels (864).

- Concerns about interest rates, overextending debt drive shopping behavior:Customers concerned about opening a HELOC are significantly more likely to consider HELOC alternatives. The most common concerns among those who shop for alternatives are variable interest rates, overextending debt and higher payment after draw period.

- Long-term HELOC customers less engaged than new customers:Existing HELOC customers who have had their line of credit for more than two years are notably less satisfied with their lender than are new customers. Longer-term customers also have lower levels of product understanding and awareness of offerings. Satisfaction increases the more engaged the HELOC customer is with their lender.

"There are some very obvious areas where HELOC providers could make tremendous improvement by taking certain steps," said Cabell. "One of the easiest is alleviating customer concerns during the shopping process by publishing clear information on their website about interest rates and payment schedules."

The U.S. Home Equity Line of Credit Satisfaction Study, now in its second year, measures overall customer satisfaction with the HELOC process and explores the key variables that influence customer choice, satisfaction and loyalty based on six factors: offerings and terms; application/approval process; closing; interaction with the lender; billing and payment; and post-closing and usage.

Read more...Navy Federal Deploys Mortgage-Backed Securities Platform

- Tuesday, 12 March 2019

Navy Federal Credit Union, the largest retail credit union with over $97 billion in assets, has deployed Broadridge Financial Solutions' Mortgage-Backed Securities Expert SaaS platform.

It’s a mortgage-backed securities processing solution that is engineered to give its users a competitive advantage in this multi-trillion-dollar market. Navy Federal is the first credit union that has been brought live on Broadridge platform.

The platform provides advanced functional capabilities to support front, middle- and back- office operations. MBS Expert integrates with a client's existing electronic trading platform and front- and back-office infrastructure, diminishing client start-up costs. The technology is used by more than 30 of the largest Fixed Income Clearing Corporation clearing members and asset managers.

"MBS Expert was the right choice to support our expanding business needs, and we have transacted over $2 billion worth of MBS trading leveraging MBS Expert," said William Tabri, manager of capital markets at Navy Federal Credit Union. "Navy Federal is now a full-clearing member of the FICC's MBS Division, availing us of the entire range of MBS-related services. Aside from leveraging the new relationships with other FICC member firms, we will benefit from decreased counterparty risk and a centralized margining process through the FICC."

"Broadridge's delivery of MBS Expert minimizes the time to market and expense typically associated with implementing MBS processing solutions, enabling Navy Federal to maximize its return on investment and better focus operating and staffing resources on core business functions," said Vijay Mayadas, president of global fixed income at Broadridge.

Read more...Lenders Profit Margins Improve, Stronger Demand Seen as the Reason

- Wednesday, 13 March 2019

The net profit margin outlook for mortgage lenders, while still negative, improved significantly in the first three months of 2019, due to stronger demand expectations for purchase and refinance mortgages, according to Fannie Mae's first quarter 2019 Mortgage Lender Sentiment Survey.

[caption id="attachment_9271" align="alignleft" width="352"] Doug Duncan[/caption]

Doug Duncan[/caption]

"Lenders appear less pessimistic regarding mortgage demand expectations; thus their profit margin outlook over the next three months is also slightly improved," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "While the results seem to portray the gloomiest picture of purchase mortgage demand during the prior three months in the survey's five-year history, the net share of lenders expecting rising demand over the next three months exceeded the level recorded in the same quarter last year. Lenders' view of the refinance market was somewhat rosier, as both recent and expected demand improved to the best showing in two years, helping to support lenders' improved profit margin outlook."

Additional highlights from the survey are as follows:

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

- For purchase mortgages, across all loan types (GSE eligible, non-GSE eligible, and government), the net share of lenders reporting demand growth over the prior three months remained negative and fell further to reach a new survey low. However, demand growth expectations for the next three months improved, showing a more optimistic outlook compared with one year ago.

- For refinance mortgages, while more lenders continued to report weaker refinance demand than those seeing rising demand, the net share of lenders reporting demand growth over the prior three months increased significantly to the highest level in two years across all loan types. Similarly, the net share expecting demand growth remains negative but also improved to the highest level in two years.

- Overall, lenders on net continued to report easing lending standards at a modest pace across all loan types.

- For GSE eligible loans, the share reporting easing lending standards for the prior three months was only slightly above the share reporting tightening, with the net share reporting easing lending standards reaching the lowest level in four years.

- Lenders' net profit margin outlook has stayed negative for the tenth consecutive quarter but has improved significantly from the survey low in the fourth quarter of 2018 and one-year ago.

- For the ninth consecutive quarter, "competition from other lenders' has continued to be cited as the top reason for lenders" decreased profit margin outlook. This quarter, "consumer demand" continues to be the second most important reason.

"While more lenders anticipate declining rather than rising profit margins, continuing the trend that started in the fourth quarter of 2016, the net share expecting falling profit margins decreased from a survey high in the prior quarter to the lowest share in nearly two years," said Duncan. "Lenders' improved demand outlook going into the spring selling season bodes well for our forecast of relatively flat mortgage volume this year following the double-digit drop in 2018."

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The Fannie Mae first quarter 2019 Mortgage Lender Sentiment Survey was conducted between Feb. 6, 2019 and Feb. 17, 2019 by PSB in coordination with Fannie Mae.

Read more...