-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Lending (1539)

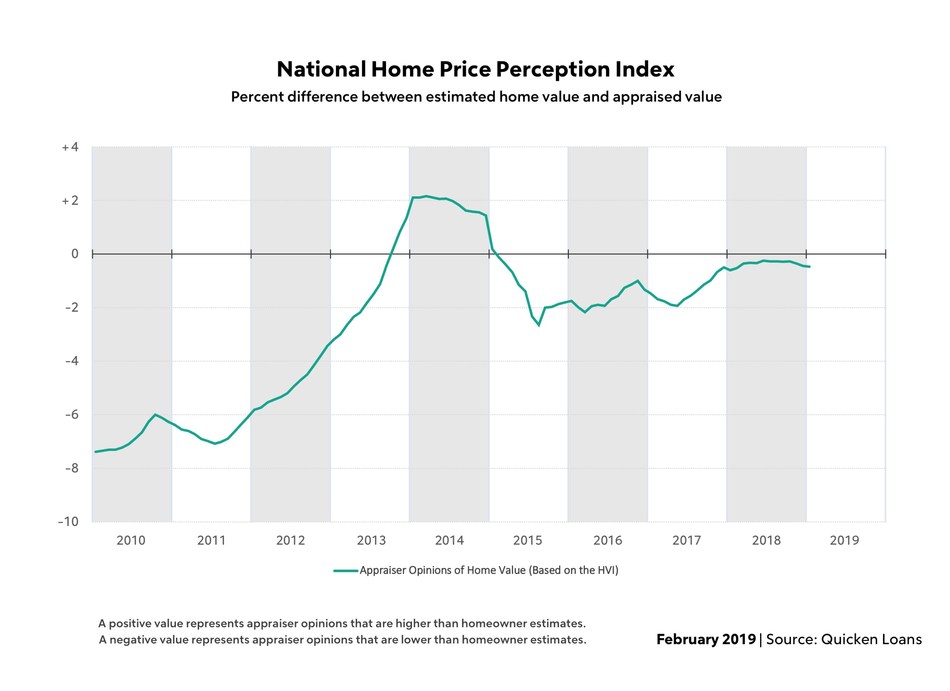

Quicken: Valuations Diverge Between Appraisers, Homeowners

The average American homeowner thinks their home is appreciating faster than appraisers do. Appraisal values in January were an average of 0.47 percent lower than what homeowners estimated, according the national Quicken Loans Home Price Perception Index. January was the third consecutive month in which the gap between these data points widened from the previous… Read more...

Tagged under

KeyBank Has Deployed Black Knight's MSP

KeyBank has implemented the Black Knight MSP servicing system for its mortgage portfolio. The aim was to drive efficiency and improve risk management at the bank. MSP delivers a scalable system, which helps clients manage all servicing processes--from payment processing to escrow administration, customer service, and default management. It was engineered to support almost any… Read more...

Tagged under

Black Knight, Others Complete D&B Acquisition; Foley Ascends to Chairman

An investor group led by Black Knight Inc. and others has completed the acquisition of Dun & Bradstreet Inc., which had already been announced. The other lead investors include Cannae, CC Capital Partners, Bilcar, and funds affiliated with Thomas H. Lee Partners. William P. Foley, was appointed executive chairman of the board for Dun &… Read more...

Tagged under

Report: Millennials Chose Purchase Loans

Millennials closed more purchased loans in December 2018, even in the face of higher-interest rates and fewer homes. [caption id="attachment_9345" align="alignright" width="200"] Tyrell: Most Millennials were single when they bought homes.[/caption] “Many Millennials are prioritizing homeownership and rather than being deterred by a tight market, they’re increasingly competing for available homes or moving to areas… Read more...

Tagged under

Home Affordability Improving: Fannie

The Fannie Mae Home Purchase Sentiment Index increased in January, rising 1.2 points to 84.7 and paring some of its recent losses-- and down 4.8 points compared with the same time last year. The increase can be attributed primarily to an eight-percentage point jump in the net share of Americans who reported substantially higher household… Read more...

Tagged under

CoreLogic: December Home Prices Rose 4.7%

The CoreLogic Home Price Index and HPI Forecast for December 2018 reported home prices rose on a year-over-year and month-over-month basis. Home prices increased nationally by 4.7 percent year over year from December 2017. On a month-over-month basis, prices increased by 0.1 percent in December 2018. Looking ahead, the CoreLogic HPI Forecast indicates home prices… Read more...

Tagged under

Black Knight Deploys Big-Data Platform

Black Knight has launched the Rapid Analytics Platform, an interactive virtual analytics lab where users can source and upload data, execute queries, perform complex analytics and train machine-learning models, from a single workspace. A cloud-based platform for working with big data, RAP features a unique, advanced workspace environment offering a dynamic mix of traditional analytics,… Read more...

Tagged under

Mortgage Credit Availability Rose In January: MBA

Mortgage credit availability increased in January according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association. The MCAI rose 2.3 percent to 179.0 in January. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to… Read more...

Tagged under

Seniors Opt to Stay in Homes Longer, Leaving Slim Pickings for Buyers

Seniors who were born after 1931are less likely to sell their homes than were previous generations—and it’s a significant cause of the housing shortage, according to the “February Insight” report from Freddie Mac. The result is around 1.6 million houses weren’t for sale through 2018, representing about one year’s supply of new construction, or more… Read more...

Tagged under

MBA: Mortgage Apps Dropped 2.5%

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Feb. 1, 2019. The previous week’s results included an adjustment for the Martin Luther King Jr. Day holiday. The Market Composite Index, a measure of mortgage loan application volume, decreased… Read more...

Tagged under

MOST READ STORIES

Fast,Easy & Free