-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Lending (1539)

Navy Federal Deploys Mortgage-Backed Securities Platform

Navy Federal Credit Union, the largest retail credit union with over $97 billion in assets, has deployed Broadridge Financial Solutions' Mortgage-Backed Securities Expert SaaS platform. It’s a mortgage-backed securities processing solution that is engineered to give its users a competitive advantage in this multi-trillion-dollar market. Navy Federal is the first credit union that has been… Read more...

Tagged under

Lenders Profit Margins Improve, Stronger Demand Seen as the Reason

The net profit margin outlook for mortgage lenders, while still negative, improved significantly in the first three months of 2019, due to stronger demand expectations for purchase and refinance mortgages, according to Fannie Mae's first quarter 2019 Mortgage Lender Sentiment Survey. [caption id="attachment_9271" align="alignleft" width="352"] Doug Duncan[/caption] "Lenders appear less pessimistic regarding mortgage demand expectations;… Read more...

Tagged under

CFPB Report: Some Servicers’ Late Fees Run Amok of Regs

The Consumer Financial Protection Bureau examinations determined that mortgage servicers charged borrowers late fees greater than the amount permitted by their mortgage notes. To be sure, examiners identified several types of affected mortgage notes. For example, certain Federal Housing Authority mortgage notes permit servicers to collect late fees in the amount of 4 percent of… Read more...

Tagged under

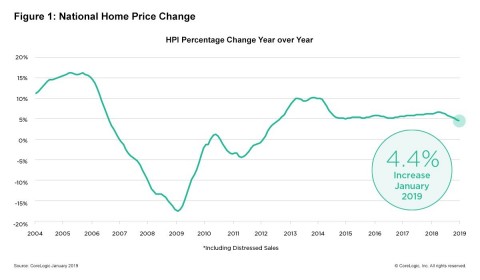

Gap Between Appraiser Opinions, Homeowner Perception of Value Widens: Quicken

February marks the fourth consecutive month the gap between owner estimates and appraiser opinions of home value has widened, though the difference remains small at a national level. Appraisal values in February were an average of 0.5 percent lower than what homeowners expected, according to the National Quicken Loans Home Price Perception Index. Home-value perception… Read more...

Tagged under

First United Reports Net Income of $10.7M for 2018

First United Corp. reported consolidated net income available was $10.7 million for the year ended Dec. 31, 2018, compared to $4.1 million for 2017. First United is a holding company and the parent company of First United Bank & Trust. Basic and diluted net income per common share for the year ended Dec. 31, 2018 … Read more...

Tagged under

CoreLogic Integrates OnSite with Encompass Platform

CoreLogic has integrated its OnSite property condition reports with the Ellie Mae Encompass platform. OnSite is a property condition report coupled along with a local market conditions and patent-pending features that are specifically designed to help institutions meet the Federal requirements when an automated valuation model is used for mortgage lending purposes. “Organizations are always… Read more...

Tagged under

Trade Groups Urge FASB to Delay CECL

Nine financial services trade organizations are urging in a joint letter to the Financial Accounting Standards Board to delay implementation of its current expected credit loss standard to ensure there are no unintended consequences. Among the nine groups are CUNA and the Mortgage Bankers Association. In response to a proposed change in implementation of CECL,… Read more...

Tagged under

Fannie's HPSI Holds Steady in February, Borrowers Less Bullish on Home Prices

The Fannie Mae Home Purchase Sentiment Index decreased 0.4 points in February to 84.3, reversing some of the increase seen in January. The HPSI is down 1.5 points compared with the same time last year. The largest change among the HPSI components this month was a 9-percentage point drop in the net share of Americans… Read more...

Tagged under

Rates Rise, Reports Freddie Mac

Freddie Mac reported that mortgage rates rose after weeks of moderating, according to its “Primary Mortgage Market Survey.” [caption id="attachment_9187" align="alignleft" width="241"] Sam Khater[/caption] “While mortgage rates very modestly rose to 4.41 percent this week, they remain below year-ago levels for the fourth week in a row,” said Sam Khater, chief economist for Freddie Mac.… Read more...

Tagged under

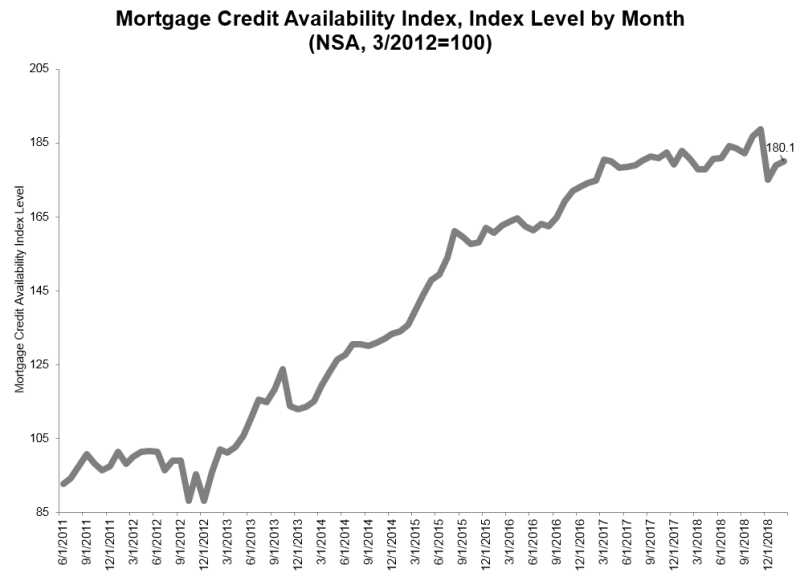

Mortgage Credit Availability Index Increases in February

The Mortgage Credit Availability Index rose 0.6 percent to 180.1 in February, according to a report from the Mortgage Bankers Association that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The… Read more...

Tagged under

MOST READ STORIES

Fast,Easy & Free