-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Lending (1539)

Consumer Borrowing Climbs for Second Month in a Row

- Wednesday, 17 July 2019

- Lending

- Written by Chris Frankie

Mortgage Biz Should Prep for New Rate Index: Fed Group

- Tuesday, 16 July 2019

- Lending

- Written by Chris Frankie

Fed Chair: Trump Won’t Make Me Step Down

- Monday, 15 July 2019

- Lending

- Written by Chris Frankie

Meeting America’s Affordable Housing Needs Requires GSE Reform, and More

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

Apartment Demand Jumps, Home Rentals Gain Favor

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

California, Hawaii Have the Most Mortgage Debt

- Wednesday, 10 July 2019

- Lending

- Written by Chris Frankie

Stearns Holdings Files for Bankruptcy in Deal to Stay Open

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

Mortgage Delinquency Falls to 20-Year Low

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

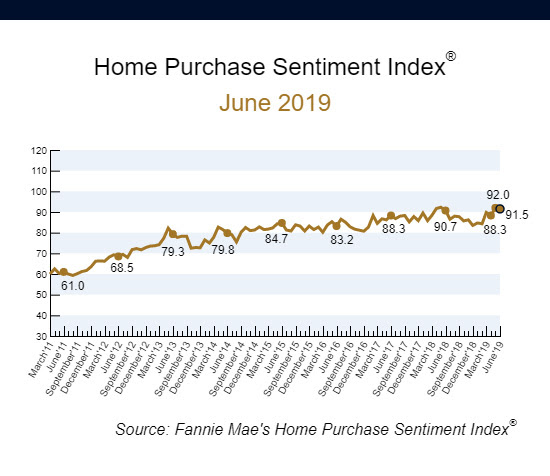

Housing Confidence Dips But Remains Near Survey High

- Monday, 08 July 2019

- Lending

- Written by Chris Frankie

Mortgage Rates Inch Up, Vets to Pay More

- Friday, 05 July 2019

- Lending

- Written by Chris Frankie

MOST READ STORIES

Fast,Easy & Free