-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Lending (1539)

Clear Capital Unveils Data-Driven Appraisal Option

Clear Capital today unveiled its Modern Appraisal Program, giving lenders turnkey access to the industry's emerging bifurcation initiatives for originating loans. The program is live nationwide and already being used to complete several thousand transactions per month on origination loans, with further aggressive expansion planned throughout 2019 and beyond. "The ongoing technology, data, and process… Read more...

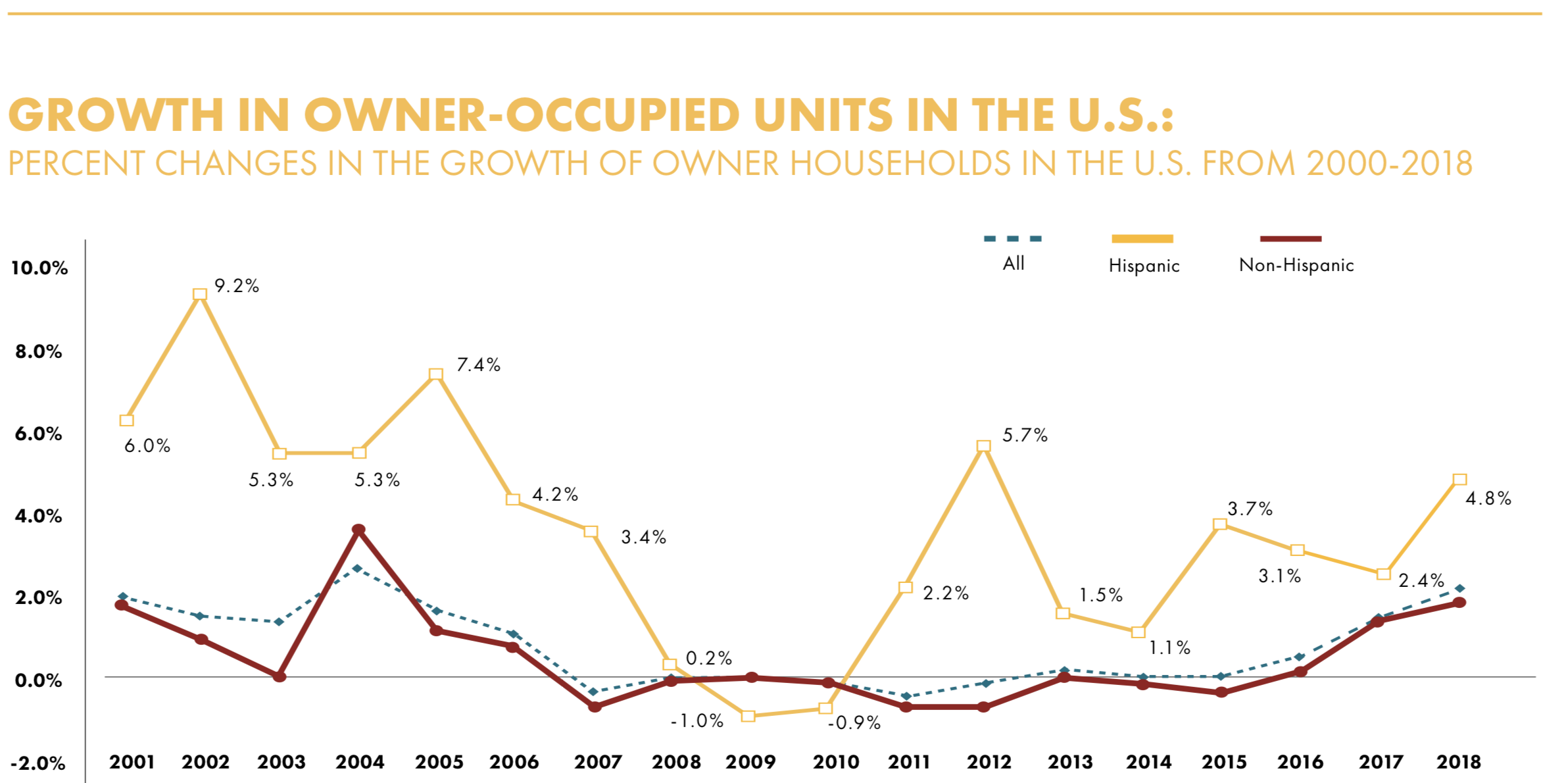

Hispanics More Than Twice As Likely To Have FHA Loans

Recently the National Association of Hispanic Real Estate Professionals (NAHREP) issued their annual report on the state of Hispanic homeownership which was authored by Marisa Calderon, Executive Director, NAHREP. Below are some of the housing and mortgage related conclusions from this report. HOUSEHOLD FORMATION Hispanics formed 485,000 new households in 2018, accounting for 32.4 percent… Read more...

Independent Mortgage Bankers’ Production Volume and Profits Down in 2018

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $367 on each loan they originated in 2018, down from $711 per loan in 2017, the Mortgage Bankers Association (MBA) reported today in its Annual Mortgage Bankers Performance Report. “Despite a healthy economy in 2018, the mortgage market suffered, as rate… Read more...

Things to Consider When Crafting Your Servicing Strategy

At IMN’s Residential Mortgage Servicing Rights Forum an afternoon panel discussed servicing related strategies. One thing is clear, it’s a big investment to do it yourself. You have to consider infrastructure, compliance ( which has gone down recently but isn’t going away) and your ability to protect information. There are also the people issues, do… Read more...

Land Gorilla Now Integrated with Calyx Path

Integration Streamlines and Mitigates Risks of Construction Loan Process Calyx Software, a leading provider of comprehensive mortgage software solutions for banks, credit unions, mortgage bankers, wholesale and correspondent lenders and brokers, announced today that Path®, its cloud-based, dynamic mortgage loan origination software (LOS), is now integrated with Land Gorilla, the leading construction loan management software… Read more...

Industry Comment: 4 Points Regulators Need to Consider Before Raising Appraisal Thresholds

By Paul Doman Later this year, the FDIC, the Federal Reserve, and the Office of the Comptroller of the Currency will decide whether to increase the threshold for residential real-estate transactions requiring an appraisal to $400,000, from $250,000. As regulators consider this change, there are four key points that should be addressed: Is insufficient cost… Read more...

Strategies for Managing Through Tough Times – Part 1

In the second session of the day at IMN’s Mortgage Servicing Rights Forum executives from lending companies talked about their MSR and lending strategies coming off last year’s low origination environment. Cutting costs to protect the bottom line was a natural strategy. But because several had already moved to a variable cost model a lot… Read more...

FHA Changes Could Affect MSR Values

[caption id="attachment_11837" align="alignleft" width="300"] Dominic Purviance, Federal Reserve Bank of Atlanta[/caption] At IMN’s Residential Mortgage Servicing Rights Forum today, a roundtable discussion on The Economy, Interest Rates, the MSR Market and its Supply/Demand Dyanamics and Cycle” underscored what the focus was when assessing MSR’s. Mike Carnes, managing director at MIAC, put the value of outstanding… Read more...

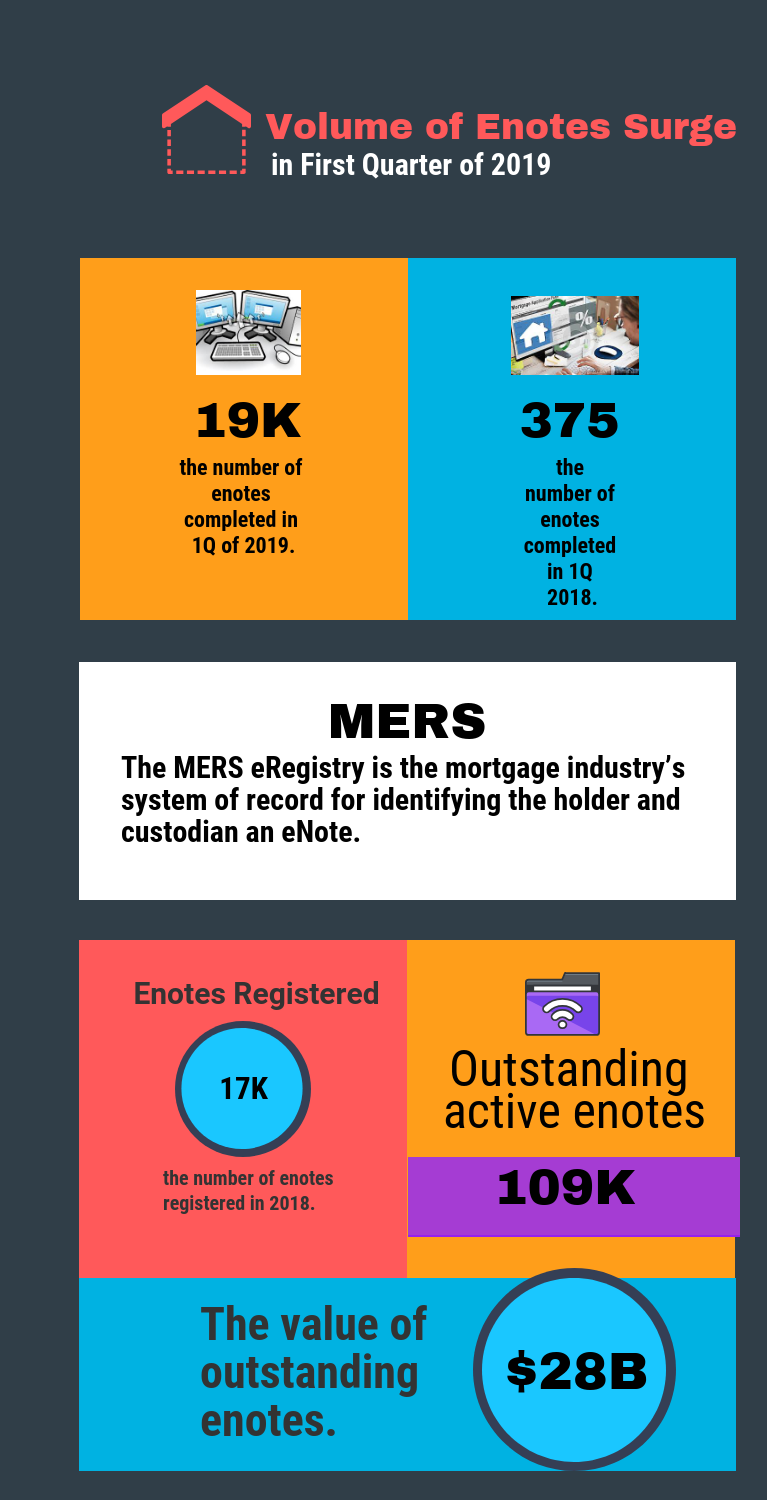

Volume of Enotes Surge: Merscorp

The number of enotes that have been added to the MERS eRegistry during the first quarter of 2019 exceeded the number of enotes registered for all of 2018, according to Merscorp Holdings Inc. MERS member institutions, including lenders and originators, registered around 19,000 enotes in the first quarter of 2019, compared to the 17,000 enotes… Read more...

New Appraisal Thresholds Leave Borrowers in Risky Position

[caption id="attachment_11791" align="alignleft" width="140"] Stephen Wagner, president of the Appraisal Institute[/caption] New appraisal thresholds could leave borrowers in an untenable, risky position. The reason is that the Office of the Comptroller of the Currency, Department of Treasury, the Federal Reserve and the Federal Deposit Insurance Corp. are considering raising the appraisal threshold for residential mortgages… Read more...MOST READ STORIES

Fast,Easy & Free