-

Navigating Volatile Markets: Strategies for Mortgage Lenders in 2023 Explore strategies for mortgage lenders to navigate volatile market conditions in 2023, focusing on interest rate adaptation, digital transformation, and customer-centric approaches.

Navigating Volatile Markets: Strategies for Mortgage Lenders in 2023 Explore strategies for mortgage lenders to navigate volatile market conditions in 2023, focusing on interest rate adaptation, digital transformation, and customer-centric approaches.

Lending (1527)

Heard Around the Industry: Arch MI Updates RateStar

Arch Mortgage Insurance Company has updated their premium pricing tool, RateStar, to provide express quotes and customized pricing options through a portal. RateStar was launched 10-years ago as a tool that could evaluate individual loan risk with more precision than any rate sheet. RateStar offers a mortgage insurance buydown feature, and its buydown feature allows… Read more...

Mortgage Applications Surge 18.6%

Mortgage applications increased 18.6 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending March 29, 2019. The Market Composite Index, a measure of mortgage loan application volume, increased 18.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index… Read more...

Mountain America Deploys Digital Deposit Account Tool

Mountain America Credit Union has deployed a new digital deposit account tool from Blend. The tool enables the credit union to offer a seamless digital-account opening experience to consumers across desktop and mobile, within existing mortgage or home-equity-lending workflows. Mountain America Credit Union was able to roll-out Blend's deposit account product in one month, with… Read more...

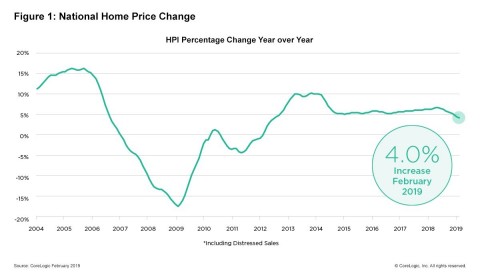

CoreLogic Predicts Home Prices Will Rise 4.7%

Home prices will rise by 4.7 percent on a year-over-year basis between February 2019 and February 2020, , according to the CoreLogic HPI Forecast. On a month-over-month basis, home prices are expected to decrease by 0.5 percent between February 2019 and March 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using… Read more...

Constellation Mortgage Acquires Mortgage Builder

Constellation Mortgage Solutions Inc has acquired Mortgage Builder, a provider of loan origination and servicing software systems. Mortgage Builder provides software to mortgage banks, community banks, credit unions and other financial institutions. In addition to loan origination software, its offerings include, servicing, relationship management, document management and a production portal. [caption id="attachment_11458" align="alignleft" width="147"] Scott… Read more...

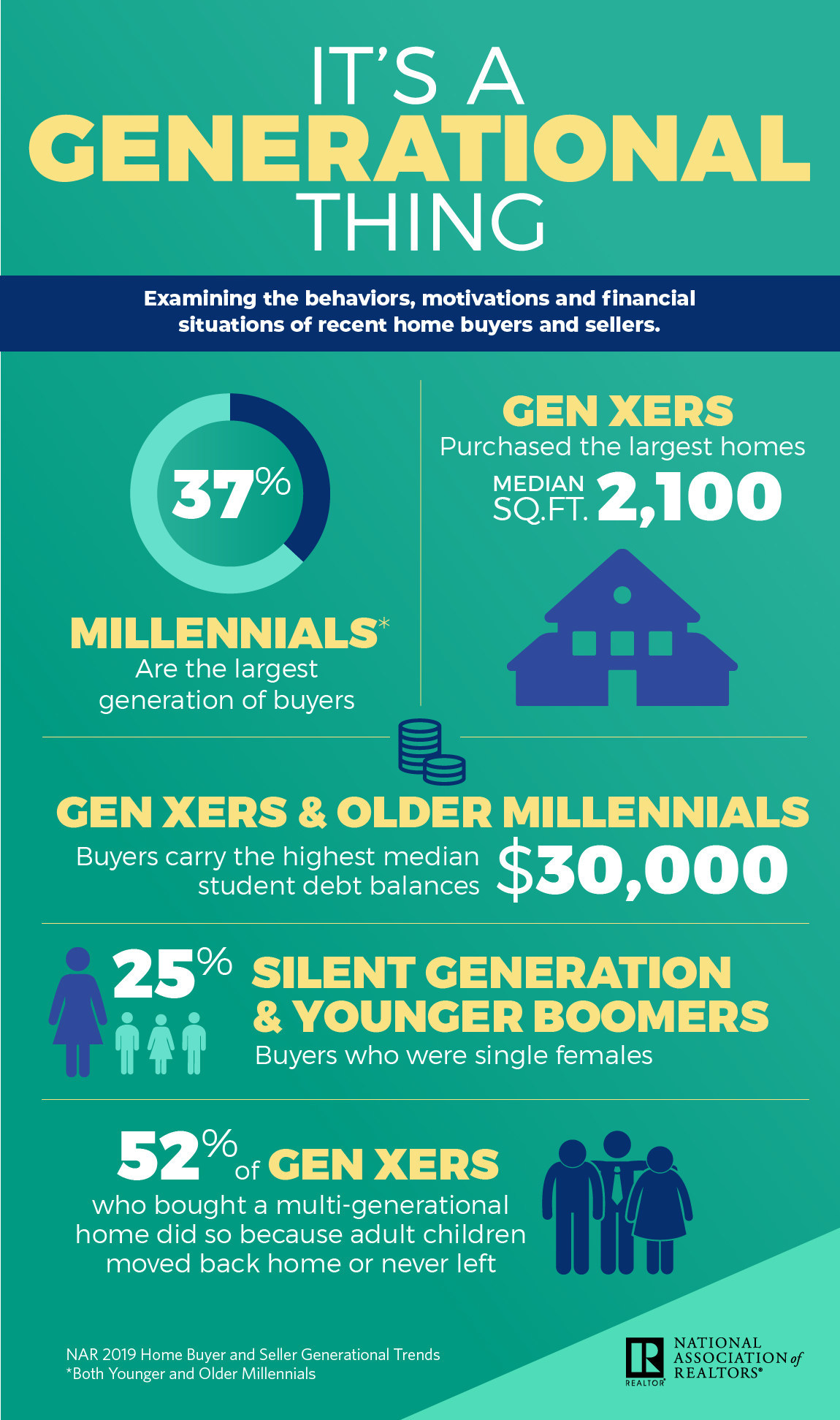

Gen Xers Buying Multi-Generational Homes

One in six Gen Xers purchased a multi-generational home, overtaking younger boomers as the generation most likely to do so. Fully 52 percent of those buyers did so because their adult children have either moved back or never left home, according to the National Association of Realtors' 2019 Home Buyer and Seller Generational Trends study,… Read more...

MISMO To Expand Standards for Mobile Devices

MISMO, the mortgage industry's standards organization, is expanding its JavaScript Object Notation initiatives designed for mobile use and some transactions. A new group, known as the JSON Development Workgroup, will create guidelines for implementing JSON in business-to-business and business-to-consumer environments. It will also as well as to develop example JSON reference implementations. “JSON is the… Read more...

Transworld Systems to Acquire Altisource’s Financial Services Business

Transworld Systems Inc., a provider of analytics-driven accounts receivable management, healthcare revenue cycle and loan servicing solutions, has entered into a definitive agreement to purchase the financial subsidiaries of Altisource Portfolio Solutions for $44 million. The acquisition is expected to close before the end of the third quarter and is subject to customary closing conditions… Read more...

Sloan Steps Down as CEO of Wells Fargo

Timothy J. Sloan, has resigned as CEO, president and member of the board at Wells Fargo & Co., due to controversy surrounding a sales practices scandal. On a conference call Thursday, analysts were unsuccessful in their attempts to receive a direct answer to whether regulators had had forced Sloan to resign, or even whether criticism… Read more...

Lower Rates Spurred Big Increase in Refis

Mortgage applications increased 8.9 percent from one week earlier,according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending March 22. The Market Composite Index, a measure of mortgage loan application volume, increased 8.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index… Read more...MOST READ STORIES

Fast,Easy & Free