-

Navigating Volatile Markets: Strategies for Mortgage Lenders in 2023 Explore strategies for mortgage lenders to navigate volatile market conditions in 2023, focusing on interest rate adaptation, digital transformation, and customer-centric approaches.

Navigating Volatile Markets: Strategies for Mortgage Lenders in 2023 Explore strategies for mortgage lenders to navigate volatile market conditions in 2023, focusing on interest rate adaptation, digital transformation, and customer-centric approaches.

Lending (1527)

Nierenberg: NewRez to Originate Around $15B in 2019, Twice 2018's Volume

The volume of originations NewRez has targeted for 2019 is around $15 billion, double the $7.2 billion in originations the company completed in 2018. NewRez, formerly New Penn, is a subsidiary of New Residential Investment Corp. “As we look at 2019, a lot of that [growth] has to do with our own recapture and some… Read more...

Construction Starts Rise 2%

The value of new construction starts in January advanced 2% compared to December, reaching a seasonally adjusted annual rate of $722.5 billion, according to Dodge Data & Analytics. The slight gain followed the loss of momentum that was reported toward year-end 2018, with [caption id="attachment_5116" align="alignleft" width="319"] Robert Murray, chief economist for Dodge Data[/caption] construction… Read more...

Tagged under

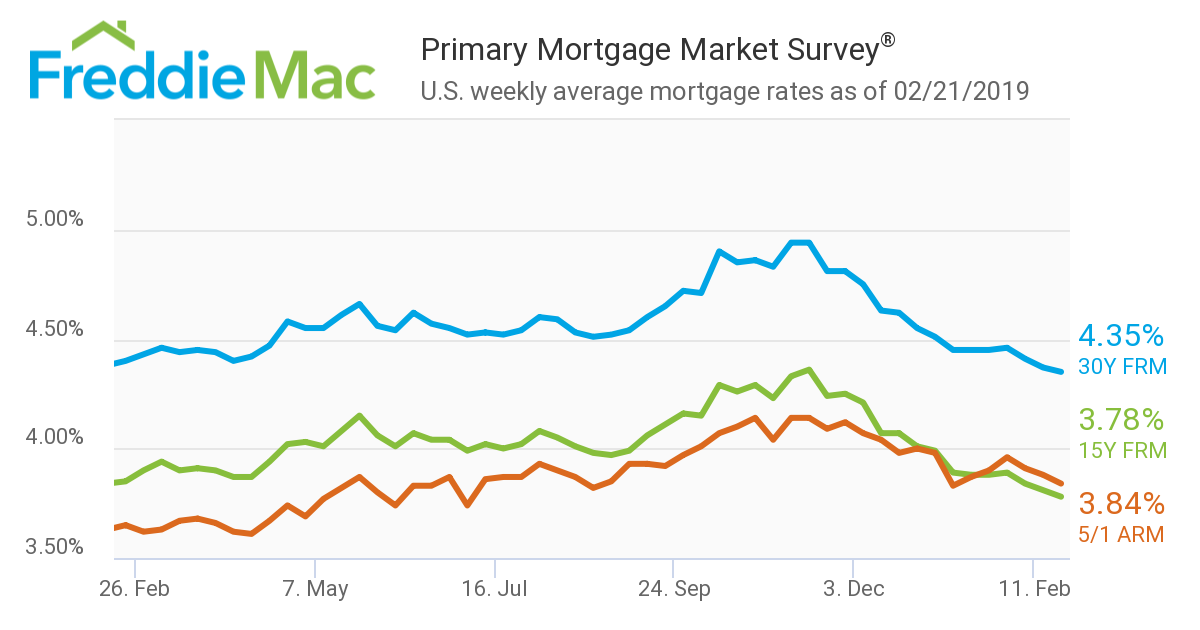

Mortgages Rates Continue Dropping

Mortgages rates continue to drop, according to Primary Mortgage Market Survey from Freddie Mac. “Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year,” said Sam Khater, Freddie Mac’s chief economist. “Wages are growing on par with home prices for the first time in years, and with… Read more...

Tagged under

Stearns Lending Promotes Steve Smith to President

Stearns Lending has appointed Steve Smith to the role of president, in which he will focus on growth opportunities for the 12th largest non-bank lender in the U.S. Smith will work with David Schneider, chief executive officer of the company, and will continue in his current role as chief financial officer. Also, he has been… Read more...

Tagged under

TIAA Bank Eliminating Retail Lending Via Branch Network

TIAA Bank plans to eliminate the branch-based retail home-lending business—and concentrate on originating home mortgage loans through existing digital mortgage capabilities. “We understand that borrowers today need fast, convenient and cost-effective solutions,” said Blake Wilson, chairman and chief executive officer of TIAA Bank. “The changes we’re making will enable us to deliver [caption id="attachment_10244" align="alignleft"… Read more...

Tagged under

S&P-Experian: Credit Default Rates Stable in January 2019

The composite S&P/Experian Consumer Credit Default Indices rate rose one basis point from last month to 0.90 percent. The bank card default rate rose eight basis points to 3.42%. The auto-loan default rate fell four basis points to 0.99%. The first mortgage default rate was two-basis points higher at 0.69%. The indices represent a comprehensive… Read more...

Tagged under

MISMO Unveils Remote Online Notarization Standards

MISMO has released remote online notarizations standards for a 60-day public comment period—in a bid to ensure lenders avoid the inefficiency of dozens of state-level protocols. The aim is for the standards to face a rigorous review from organizations and industry participants—that demonstrates the standards are ready for broad use across the mortgage industry. Once… Read more...

Tagged under

Pentagon Federal, Black Knight Ink Deal for Servicing, Default Services

Pentagon Federal Credit Union, the second largest credit union in the U.S., has inked a deal for the MSP loan servicing system, default solutions and other applications from Black Knight. The MSP system encompasses all aspects of servicing--from loan boarding to default-- for first mortgages and home-equity loans and lines of credit. Used to service… Read more...

Tagged under

Housing Inventory: Increased 6.4% Year Over Year, Establishing a Record

A sixth consecutive month of declining home sales in January contributed to the largest year-over-year inventory increase in at least 10 years, according to the RE/MAX National Housing Report. While year-over-year home sales dropped 11 percent, extending a streak that began in August, inventory grew year-over-year by an average of 6.4 percent across the report's… Read more...

Tagged under

Arch Reported $121M Net Income

Arch Capital Group Ltd. reported net income of $126.1 million, or $0.31 per share, a 5.9% annualized return on average equity, compared to $203.5 million, or $0.49 per share, for the 2017 fourth quarter. Pre-tax current accident year catastrophic losses, net of reinsurance and reinstatement premiums were $118.2 million, primarily related to Hurricane Michael and… Read more...

Tagged under

MOST READ STORIES

Fast,Easy & Free