-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Lending (1539)

Redfin Survey: More Millennial Homebuyers Saving for a Down Payment the Old-Fashioned Way

Seventy-two percent of millennial homebuyers this year are saving for a down payment directly from their paychecks, up from 69 percent last year, according to a March survey of 2,000 U.S. homebuyers and sellers commissioned by Redfin, the tech-powered real estate brokerage. Over 500 respondents born between 1981 and 1996 responded to the survey. Redfin… Read more...

FHFA Releases It's Scorecard Progress Report.

The FHFA on Friday released its Progress Report that summarizes the progress Fannie and Freddie have made in achieving the FHFA’s three strategic goals of: MAINTAIN, in a safe and sound manner, foreclosure prevention activities and credit availability for new and refinanced mortgages to foster liquid, efficient, competitive, and resilient national housing finance markets; REDUCEtaxpayer… Read more...

Visionet Hires Martin Foster for Leadership Roll

Mortgage Servicing leader with 35 years of experience joins as Senior Vice President, Consumer Lending Visionet Systems Inc., a global technology and services provider to the US mortgage industry, announced today that the company has hired Martin Foster, a mortgage servicing leader with 35 years of industry experience. [caption id="attachment_12087" align="alignleft" width="287"] Martin Foster,… Read more...

Newly Released Census Data Show Surprising Drop in Homeownership Rate

Census Data released yesterday showed that the U.S. rate of homeownership fell from 64.8% in the fourth quarter of 2018 to 64.2% in first quarter of 2019. This was a larger than anticipated drop that put an end to the steady gains that have been made since Q1 2017. Of the four regions in the… Read more...

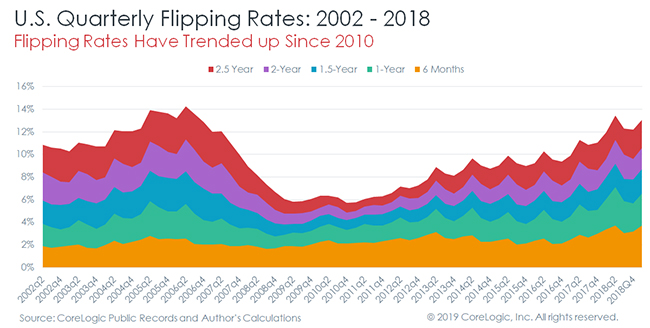

Flipping Rates Near Historic Highs, But Flippers Are Playing a Different Game

According to recent report issued by Corelogic, home flipping continues to rise and is currently at the hightes level since they started tracking in 2002. This time however it isn’t just a matter of investors focusing on quick fix based on speculative house price movements, like in the past. Now short-term investors are focused on… Read more...

The 30 Year Loan Is Riskier and Drives Up Entry Level Home Prices

In a recently posted article, Edward J. Pinto, a resident fellow and the codirector of the Center on Housing Markets and Finance at the American Enterprise Institute (AEI), took aim at the usefulness of the 30- year mortgage. His feeling is that the slow amortization makes it nearly twice as risky as a similar loan… Read more...

Small Dollar Mortgages Are No Riskier Than Mid-Size Mortgages

By Alanna McCargo and Sarah Strochak, Urban Institute The difficulty of obtaining mortgages for low-cost homes has made homeownership even harder at the most affordable end of the spectrum. Only one in four homes purchased for $70,000 or less in 2015 was financed with a mortgage, compared with almost 80 percent of homes worth between… Read more...

CFPB Announces Policy Change Regarding Bureau Civil Investigative Demands

In an effort to increase transparency and move away from its “regualation by enforcement” stereotype, the CFPB on Tuesday announced that it is changing it’s policy on Civil Investigation Demands (CID’s). The new poicy will ensure the CFPB provides more information about the potentially wrongful conduct under investigation.CIDs will also typically specify the business activities… Read more...

Black Knight's "First Look" Shows Delinquencies Down, Prepayments Up

According to Black Knight’s “first look” report on March mortgage performance statistics, total U.S. loan delinquency ( defined as loans 30 or more days past due but not in foreclosure) fell 5.3% to 3.65%. This is down almost 2% from this time last year. This represented the smallest improvement for any March, typically the strongest… Read more...

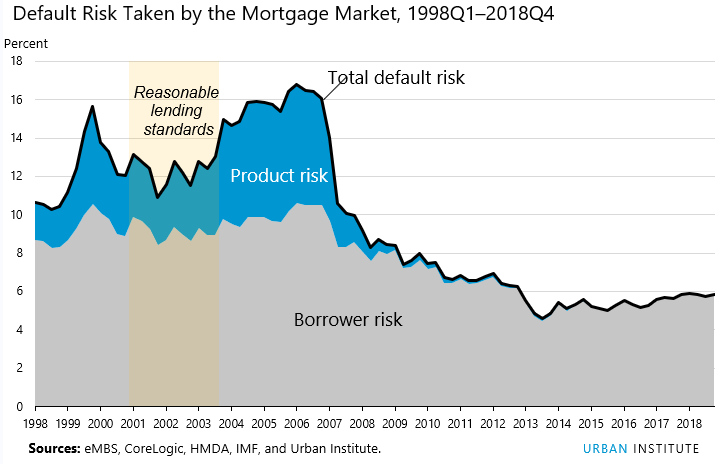

Urban Institute's Index Shows Credit Easing Has Room to Increase

The Urban Institute’s Housing Finance Policy Center updated their Housing Credit Availability Index (HCAI) last Friday. The HCAI measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and… Read more...MOST READ STORIES

Fast,Easy & Free