-

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Navigating the Future of Mortgage Lending in an Unpredictable Market Discover how mortgage lenders are adapting to market volatility, embracing digital transformation, and preparing for future trends in the mortgage lending industry.

Lending (1539)

It’s Time to Modernize Loan Disclosures, a Root Cause of Many Mortgage Industry Problems

By George Baker The mortgage industry’s consumer loan information disclosure model is antiquated, flawed, inflexible and outdated. Regulators love to regulate static outdated models like ours. Without realizing it, mortgage lenders have fostered and amplified compliance, legal and regulatory problems because we continue to do business the same, old way. As other industries provide speedy,… Read more...

Freddie Mac Appoints Brickman to CEO Post

Freddie Mac has appointed David Brickman to succeed Donald Layton who is retiring as chief executive officer on July 1. Brickman, who is the current president of Freddie Mac, will be the fourth CEO of the mortgage-finance company since the government took over the company 10 years ago. He will also join the board. The… Read more...

Two New Jersey Men Arraigned in Reverse Mortgage Scheme

Two New Jersey men have been arraigned for their roles in a reverse mortgage scheme that took advantage of elderly homeowners face up to 30-year-prison terms, according to U.S. Attorney Craig Carpenito. Philip Puccio Jr., 40, of Mahwah, N.J., and Rafael Peralta, 46, of Clifton, N.J., were indicted Feb. 8, 2019, by a federal grand… Read more...

U.S. Bank to Implement Black Knight Servicing Platform

U.S. Bank, the fifth largest commercial bank in the U.S., will implement Black Knight's Servicing Digital solution. The web solution delivers detailed, timely and highly personalized loan information to the bank’s mortgage customers about their loans and delivers "what-if" simulators and tools to show how wealth can be built from these real estate assets. Servicing… Read more...

Fidelity National Launches Digital Title Closing Capability

Fidelity National Financial has launched its digital title closings capability. Developed in partnership with Black Knight Inc. this new closing experience supports both hybrid and digital closing options and is integrated with FNF's title production systems. Designed to digitally engage homebuyers and sellers in the process well in advance of the closing signature ceremony, the… Read more...

Kroll: M&A Deals Are Slow to Materialize

Although the time is ideal for mergers and acquisitions between mortgage lenders there was just one large deal and a handful of small deals. The BB&T Corp.’s acquisition of SunTrust Banks Inc. creates the ninth largest mortgage lender in the U.S. with a 2.3 percent market share, according to the “Residential Mortgage Bank Update” from… Read more...

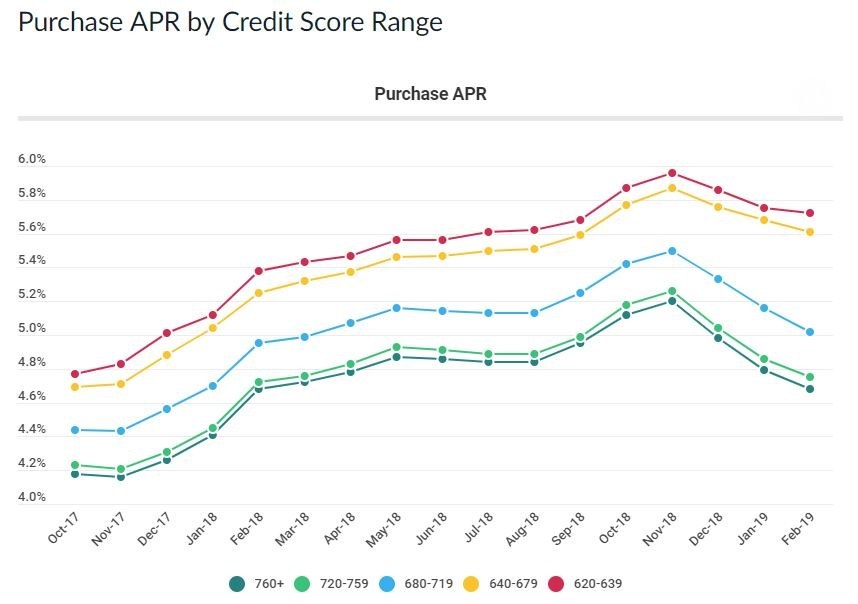

3 Reasons for Increased Price Disparity Based on Credit Scores

In LendingTree’s recently released Mortgage Offers Report, which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree's network, the data suggests that borrowers with lower credit scores aren’t realizing the full benefit of declining interest rates. "Of note, since rates started falling in December, lenders are passing through those… Read more...

Consumer Defaults Stable in February, Notes S&P-Experian

The S&P-Experian Consumer Credit Default Indices, which measure changes in consumer credit defaults, show that the composite rate rose two basis points from last month to 0.92 percent. The first mortgage default rate was one basis point higher at 0.70 percent. The bank card default rate rose six basis points to 3.48 percent. The auto… Read more...

ARMCO: Critical Defects Rate Rises 11%

The critical defect rate reached 1.89 percent in the third quarter of 2018, an increase of 11 percent, compared with 1.71 percent defect rate reported in the second quarter. It’s the second highest critical defect level since the TRID rule went into effect in October 2015, according to the “ARMCO Mortgage QC Trends Report” from… Read more...

Tagged under

First American Enhances Collateral Inspections with Mobile Tools

First American Mortgage Solutions LLC has upgraded its collateral inspection services with mobile-enabled technology. “Valuations, like all other aspects of the mortgage lifecycle, are becoming increasingly modernized and technology-driven,” said Kevin Wall, president at First American Mortgage Solutions. “With our enhanced mobile and data delivery capabilities, we’re helping lenders and valuation professionals stay ahead of… Read more...

Tagged under

More...

MOST READ STORIES

Fast,Easy & Free