-

The Rise of AI in Mortgage Origination: Transforming the Modern Lending Landscape

The Rise of AI in Mortgage Origination: Transforming the Modern Lending Landscape Discover how Artificial Intelligence is revolutionizing mortgage origination, enhancing efficiency and personalization in lending practices.

Discover how Artificial Intelligence is revolutionizing mortgage origination, enhancing efficiency and personalization in lending practices.

Originating (1388)

Expanding Your 'Sphere' Means More Business

- Monday, 25 February 2019

- Originating

- Written by matt

Tagged under

Zillow Group Reshuffles Leadership Roles

- Friday, 22 February 2019

- Originating

- Written by matt

Tagged under

New Home Sales Dipped 8% in January

- Friday, 22 February 2019

- Originating

- Written by matt

Tagged under

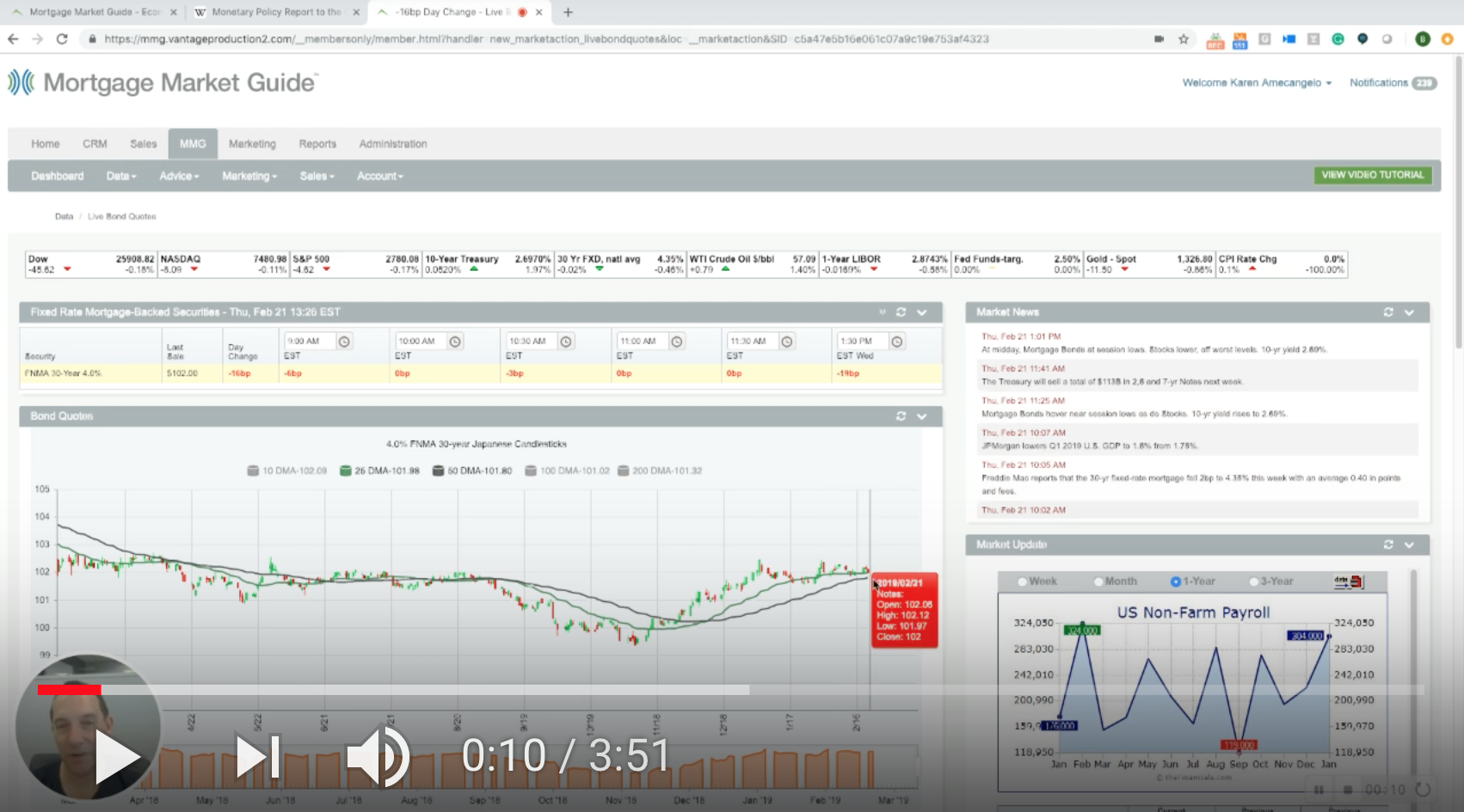

The Week's Market Insights with Bill Bodnar from the Mortgage Market Guide

- Thursday, 21 February 2019

- Originating

- Written by matt

Tagged under

Existing Home Sales Weak in January, But Have 'Likely' Reached a Low

- Thursday, 21 February 2019

- Originating

- Written by matt

Tagged under

loanDepot Technology Brings 8-Day Closings (Possibly)

- Wednesday, 20 February 2019

- Originating

- Written by matt

Rise of Millennial Home Buyers

- Wednesday, 20 February 2019

- Originating

- Written by matt

Tagged under

MGIC-Compass Making it Easier, Faster for Originators to Order Insurance

- Tuesday, 19 February 2019

- Originating

- Written by matt

Tagged under

Originators Remain Trusted Advisors, Though Tech Is Changing Their Role

- Tuesday, 19 February 2019

- Originating

- Written by matt

Tagged under

Define and Grow Your Sphere

- Monday, 18 February 2019

- Originating

- Written by matt

Tagged under

MOST READ STORIES

Fast,Easy & Free