-

The Rise of AI in Mortgage Origination: Transforming the Modern Lending Landscape

The Rise of AI in Mortgage Origination: Transforming the Modern Lending Landscape Discover how Artificial Intelligence is revolutionizing mortgage origination, enhancing efficiency and personalization in lending practices.

Discover how Artificial Intelligence is revolutionizing mortgage origination, enhancing efficiency and personalization in lending practices.

Originating (1388)

Having Confidence Helps Build Trust and Drives Originations

- Tuesday, 05 March 2019

- Originating

- Written by tim

Tagged under

Mat Ishbia discusses rising home values, broker market share and Freddie Mac's new purchase tool.

- Monday, 04 March 2019

- Originating

- Written by matt

Tagged under

A Legacy of Bad Decisions and Mortgage Banking

- Monday, 04 March 2019

- Originating

- Written by tim

Tagged under

Do You Suffer from Productionitis?

- Monday, 04 March 2019

- Originating

- Written by matt

Tagged under

Allied Mortgage Unveils Loan Tailored to Newly Minted Professionals

- Thursday, 28 February 2019

- Originating

- Written by matt

Tagged under

Ask the Management Expert: Hershman's Quick Steps to Assess Job Candidates

- Friday, 01 March 2019

- Originating

- Written by matt

Tagged under

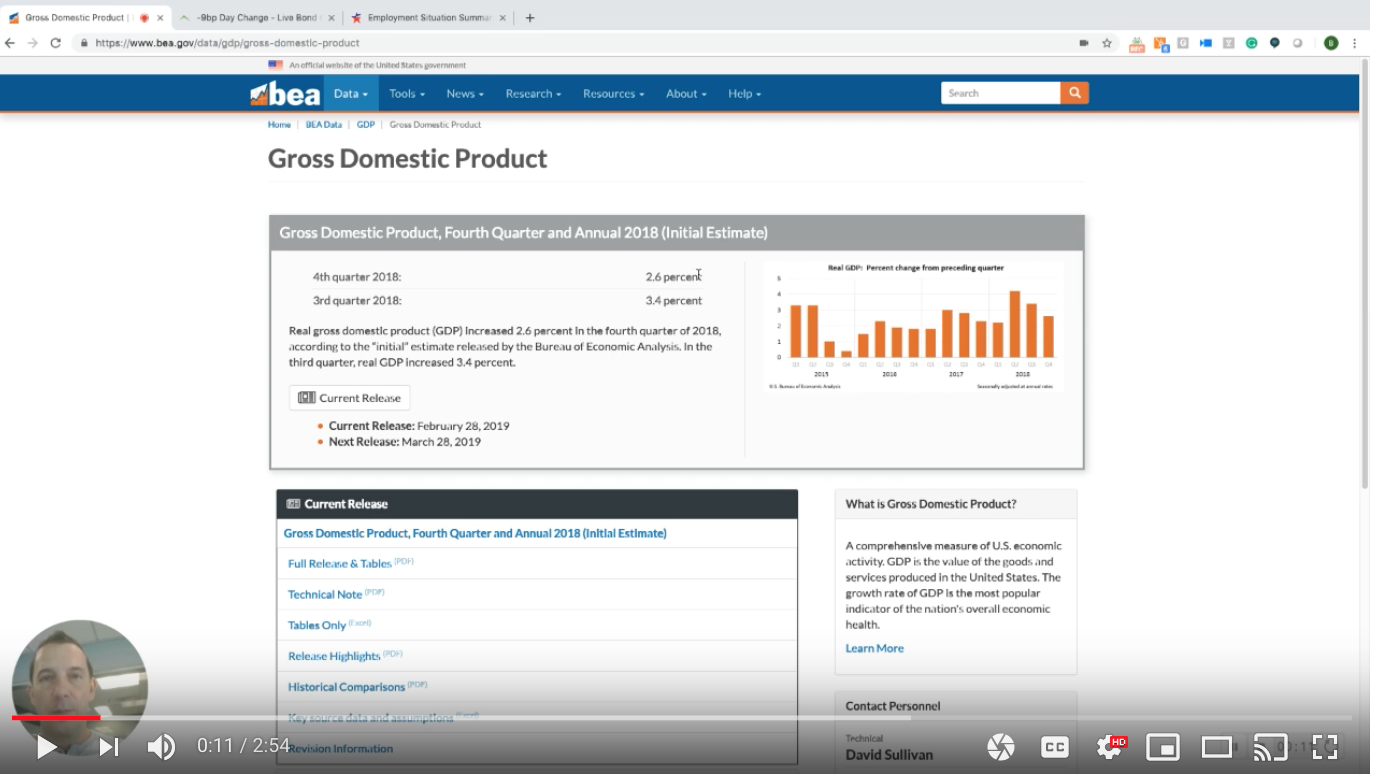

The Week’s Market Insights with Bill Bodnar and the Mortgage Market Guide

- Friday, 01 March 2019

- Originating

- Written by harshal

Tagged under

This Week In the Markets with Bill Bodnar from the Mortgage Market Guide

- Thursday, 31 January 2019

- Originating

- Written by matt

Tagged under

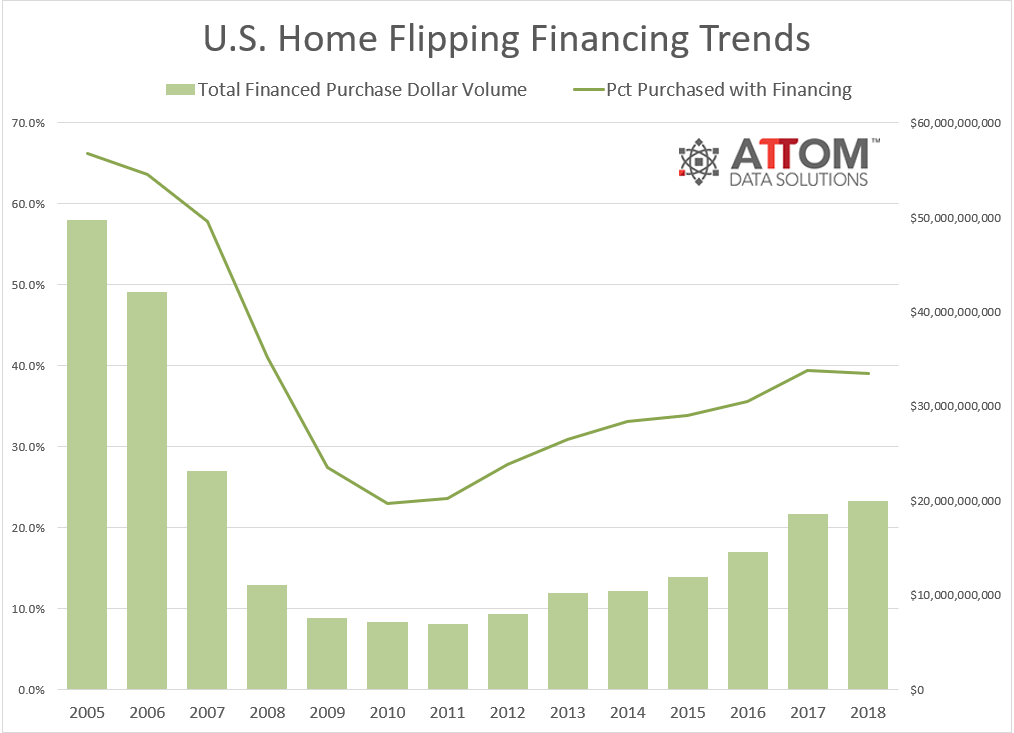

Number of Homes Flipped Fell 4%: Attom Data

- Thursday, 28 February 2019

- Originating

- Written by matt

Tagged under

NewRez Offers Originators Social Media, Content Training

- Tuesday, 26 February 2019

- Originating

- Written by matt

Tagged under

MOST READ STORIES

Fast,Easy & Free